Opportunities Remain for Industrial Fluid Power Applications

What you’ll learn:

- Why some industrial applications are switching from fluid power to electric alternatives.

- The pros and cons of hydraulic, pneumatic and electric actuation technologies.

- Where opportunities exist for use of hydraulics and pneumatics in industrial applications.

Fluid power systems continue to be the technology of choice in many industrial applications such as packaging and machine tools. However, over the last decade the use of electric alternatives has increased as machine OEMs and their customers look to improve efficiency and precision.

Each technology has its pros and cons, and applications or tasks for which they are best suited. Understanding these is critical to ensuring the right option is chosen.

While electric alternatives are becoming more prevalent, that does not mean fluid power systems are going away any time soon. There continue to be a number of opportunities in industrial applications for hydraulics and pneumatics, especially as fluid power and electric technologies come together to meet requirements for increased efficiency and precision.

In this final installment of our Q&A series on industrial fluid power, members of the hydraulics and pneumatics sector discuss how they are seeing electric alternatives being utilized within industrial applications. They also offer their thoughts on the many opportunities that remain for fluid power in these applications.

Read the first two parts of our industrial fluid power Q&A series which offer insight into the benefits hydraulics and pneumatics offer various industrial applications and the trends driving fluid power system designs.

Part 1: Hydraulics and Pneumatics Benefit a Range of Industrial Applications

Part 2: Industrial Applications Require Smart and Efficient Fluid Power Systems

Power & Motion: Are you seeing electric alternatives replacing hydraulics and pneumatics in industrial applications? If so, what is prompting the use of these electric alternatives and what types of applications are they typically being utilized in?

Andrew Aurand, Director of Sales & Marketing, Clippard: Yes, we are seeing electric alternatives being adopted, but it’s more of a strategic choice for specific tasks rather than a wholesale replacement. The decision is driven by applications that demand the unique benefits electric systems offer.

In terms of what's prompting the switch, it is:

- Precision and Complex Control: Electric actuators provide programmable, multi-point positioning and precise control over force and speed, which is something simple fluid power systems can't easily replicate.

- Energy Efficiency: Electric systems consume power only when moving, offering significant long-term energy savings compared to constantly running compressors or hydraulic power units.

- Data and Connectivity: They are inherently digital, easily providing feedback on position and force, which is essential for Industry 4.0 applications and process monitoring.

- Clean and Quiet Operation: With no risk of air or oil leaks, electric actuators are ideal for clean environments like medical, food, and electronics manufacturing.

In terms of where they are being used, you'll typically find electric alternatives in applications where the need for precision and data outweighs the higher initial cost:

- Packaging and Assembly: For tasks requiring exact positioning, like precision filling, labeling, or robotic assembly.

- Medical and Lab Automation: Where clean operation and highly repeatable, controlled movements are critical.

- Metal Forming: In smaller presses where precise force and position control are needed to ensure part quality.

- Automated Logistics: For high-speed, precision sorting and material handling systems.

In short, while fluid power remains the go-to for simple, high-speed, and high-force applications due to its power density and cost-effectiveness, electric systems are being chosen for more complex, data-rich, and precision-focused tasks.

Jacob Paso, President, Delta Motion: There has been a long-term trend toward replacing fluid power with electric, and many of those are good choices, especially where forces are low and there is minimal shock or vibration. Unfortunately, some are based on a misunderstanding of technology — in particular, we still run into people that are not aware that very precise position and force control can be done with a modern hydraulic motion controller.

There are also misconceptions regarding energy savings. Hydraulics can be efficient in holding pressure and handling intermittent high loads. It is important to think of it in terms of energy consumed to produce a certain result rather than simply comparing actuators. For example, if a precision hydraulic deep-drawing press uses 50% more energy and produces twice the number of usable parts, there is a large net energy savings.

Cindy Cookson, VP & GM, Fluid Power Americas, Gates Corp.: We’re seeing electric alternatives starting to gain ground, but mostly in lighter-duty applications where simplicity and minimal maintenance are priorities. For heavier loads, which is our bread and butter, hydraulics still dominate because they offer unmatched power density and flexibility. With Gates’ advanced hose and coupling technologies, customers get compact, high-performing solutions that electrics simply can’t replicate in demanding industrial settings. We believe hydraulics remain firmly in place across medium- and heavy-duty markets.

Michelle Gladysz, Product Line Manager – MFB Valves, Moog Industrial Group: It's certainly a case-by-case basis. I think a lot of it has to do with the availability of a pumping system nearby, having that [hydraulic] infrastructure. Maybe we still want a hydraulic system, but we don't have [readily available] access to our own hydraulic supply, so we also need to incorporate a little pump right on board as well.

The entertainment industry is a good example of [a sector] that's veered farther away from hydraulics over the years. If you were to look back many, many years ago, even the little animatronic characters in theme parks, those types of robots, all were hydraulically controlled at the time. But it's not very feasible to have pumps and hydraulic supply all over a park, so a lot of that stuff where it's not as easy to manage the actual fluid has moved away [from hydraulics]. Most of that stuff is electric motors and electric controls.

That said, some of the entertainment industry is coming back to hydraulics; we see applications on some of the simulator rides, where they are looking for a little bit more control and a little more precision, they're trying to move a much bigger item, [sometimes] a room of people, in a lot more precise way to simulate an environment. So, some of those are incorporating a pump in a packaged unit to have the hydraulic system and pump right there locally on the actuator, to still be able to get that control and power, but not have hydraulic lines plumbed into the building the same way that maybe we do in a test center.

We have a very big flight simulator portfolio here [at Moog] that's all turned to electric at this point. At least 5+ years ago, the large majority of those turned to electric systems, based off of the need to have an independent system that we've been able to develop control technology for. I think the challenge is it has a lot more software requirements, system integration, and a whole electronics cabinet that comes along with it, but that's easier to manage for that industry than hydraulic supply at the various training centers around the world.

Dan Detweiler, Value Added Systems and Technical Services Manager, Parker Hannifin: General sustainability and green energy messaging implies that electric alternatives are a solution that should be considered wherever possible. There are a few areas where hydraulics have been replaced by high force electromechanical systems. Medical device machine tools remove hydraulics to eliminate contamination possibilities for the oil. We have seen some automotive assembly lines go 100% hydraulic-free and in those areas, they focused on electric and pneumatic solutions that were once hydraulic, such as frame turnover machines; presses and extruders where the customer’s product cannot tolerate any contamination from potential hydraulic fluid leaks.

We are seeing electrical alternatives being requested on a more frequent basis; however, their use does have some trade-offs that have to be weighted: general environment, duty cycle, ambient electrical noise, and component life expectancy. The changes are driven by many things such as the improvement of electric actuators, lack of fluid power experience in the industries, less maintenance, and higher precision capabilities. The applications are varied and mostly seem to be low- to medium-force applications where precision is necessary or beneficial. Many single axis high-force applications have moved to a single stand alone product, like high-force electromechanical (EM) actuators or hybrid (EM/hydraulics) solutions like the HAS actuator.

Shalom Kundan, Division Marketing Manager, Parker Hannifin: Yes, in certain motion control applications where precision, programmability, and force control are critical, electric actuators are replacing pneumatics. Examples include positioning tasks in electronics assembly, semiconductor, and medical device manufacturing. The drivers are accuracy, data tracking, and energy efficiency.

However, for cost-sensitive, high-speed, and industrial applications, pneumatics continues to be favored. Additionally, Industry 4.0 continues to rely on pneumatics as a key enabler for increasing productivity, availability, reducing operational costs and building operational resiliency for our customers.

John Fenske, Director of Marketing, Tolomatic: Yes. An increasing number of industrial customers are pursuing electrification strategies when the application allows. The drivers vary, however, the capability and flexibility of motion control is most common. The ability to control multiple positions, velocity, acceleration, output force and the ability to change any of these parameters dynamically can be critical in some industrial applications.

Another driver that we are seeing for industrial OEMs in particular is the need to streamline their supply chains and optimize for lower lead time. The complexity associated with ordering, inventory, and assembly labor for HPUs (hydraulic power units) and compressed air systems can be high when compared to electric solutions.

Power & Motion: Do you continue to see opportunities for hydraulics and pneumatics in industrial applications in the years to come?

Andrew Aurand, Clippard: Absolutely, without question. The future of fluid power is bright, but it is evolving. The opportunity lies not in fighting other technologies, but in intelligent integration.

The future is in "smart" pneumatics. By embedding electronics and connectivity into our components, we are giving our customers the best of both worlds: the power density and robustness of pneumatics combined with the data and control of modern electronics.

We see immense growth in applications where fluid power has inherent advantages — life sciences, analytical equipment, and harsh environments. As long as there is a need for fast, simple, and powerful motion in industrial automation, there will be a strong and growing demand for pneumatics. At Clippard, we are committed to leading that innovation by developing the precise, reliable, and intelligent solutions that our customers need to build the machines of tomorrow.

Jacob Paso, Delta Motion: Hydraulics will always be important in industrial machinery. The physics of hydraulics, of oil against metal, will always be superior to metal-on-solid-surface contact. Taken together with its energy density and controllability, there is no doubt that there will always be a place for hydraulics. In fact, in some cases, companies have tried converting axes to electric only to switch back to hydraulics when the electric actuators did not hold up to shock.

Electromechanical actuators for high-force linear motion are much more expensive than hydraulic equivalents and have many more wear parts. Even if there is some net energy savings, the hydraulic solution often proves to have a much lower total cost of ownership.

Cindy Cookson, Gates Corp.: Absolutely. Hydraulics provide a unique form factor and the ability to move enormous loads efficiently, something electrics simply can’t match at this time. At Gates, we continue to see strong demand for hydraulics in applications where power density and reliability are critical, and we expect that demand to only grow. With high-quality hoses and couplings that extend life and reduce waste, hydraulics will remain an essential technology for industrial applications well into the future.

Michelle Gladysz, Moog Industrial Group: In my opinion and experience, hydraulics and pneumatics continues to be a very stable industry [and a] kind of backbone to support many industries. I don't see any brand-new technologies or anything wild and crazy coming in hydraulics; I think it's a well-studied and well-established field where we're making tweaks and continue to make things better. But I do think that there's a lot of continuing opportunity in [various] industries from heavy machinery, injection molding, plastics formation, pulp and paper, metal forming, all of those heavy industry types of applications, all the way to testing such as vibration and strength testing for airplane parts.

We're still going to need hydraulics, and I think there's still going to be demand for revisions, tweaks and improvements. Power generation continues to [produce] very stable demand in North America and other parts of the world [due to] increasing power demands. There will continue to be opportunities to tweak and make little improvements to gain a little bit more efficiency or reduce the weight [of a hydraulic component].

Dan Detweiler, Parker Hannifin: Yes, we do, the power density of hydraulics is very costly to replace by other motion control solutions. Long-term opportunities exist for hydraulics based upon the industry advancements in efficient component design in hydraulic pumps and valve technologies. The introduction of variable frequency drives to hydraulic power units over 15 years ago will continue to allow hydraulics to be a key solution where the customer needs high power density but also desires efficiency, low noise, and a HPU with a smaller footprint on the machine.

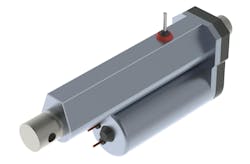

Also, the commonplace usage of motion controllers (Parker PAC120/HC) in unison with the machine PLC has enabled fluid power systems to reproduce the repeatability and precision of electromechanical solutions with more robust and less costly hydraulic designs. The force density, simplicity of products for point-to-point motion, and lower initial and replacement costs of fluid power are characteristics that machine builders rely on every day. For example, compare a hydraulic/pneumatic cylinder (linear actuator) to the alternative electric solution. Low component cost, rugged design, high reliability, and ease of repair are features that will keep hydraulics and pneumatics relevant for years to come. In summary, we believe that fluid power will continue to be a necessary technology for industrial applications for a very long time.

Shalom Kundan, Parker Hannifin: Yes, absolutely! Pneumatics will remain a core technology, especially as it evolves with smart sensors, improved efficiency, and digital connectivity. The future opportunities lie in hybrid systems, where pneumatics provide cost-effective motion and electric drives handle precision tasks. With sustainability, modular design, and IIoT (Industrial Internet of Things) integration advancing, pneumatics will continue to have a strong role in industrial automation for decades.

In summary, pneumatics will continue to be a cornerstone of industrial automation, as the industry embraces efficiency, connectivity, and integration with digital technologies. Companies that innovate in smart pneumatics, sustainability, and hybrid solutions will define the next era of competitive advantage. I believe the greatest opportunities ahead lie not in choosing between pneumatics and electric solutions, but in using both where they deliver the most value.

John Fenske, Tolomatic: Yes. While electrification strategies are becoming more common for industrial customers, there are still many applications that require the force density, speed or economics of a hydraulic or pneumatic solution. Fluid power will remain prominent in these applications for the foreseeable future.

About the Author

Sara Jensen

Executive Editor, Power & Motion

Sara Jensen is executive editor of Power & Motion, directing expanded coverage into the modern fluid power space, as well as mechatronic and smart technologies. She has over 15 years of publishing experience. Prior to Power & Motion she spent 11 years with a trade publication for engineers of heavy-duty equipment, the last 3 of which were as the editor and brand lead. Over the course of her time in the B2B industry, Sara has gained an extensive knowledge of various heavy-duty equipment industries — including construction, agriculture, mining and on-road trucks —along with the systems and market trends which impact them such as fluid power and electronic motion control technologies.

You can follow Sara and Power & Motion via the following social media handles:

X (formerly Twitter): @TechnlgyEditor and @PowerMotionTech

LinkedIn: @SaraJensen and @Power&Motion

Facebook: @PowerMotionTech