Fluid Power Remains Fundamental to Industrial Applications

What you’ll learn:

- The benefits hydraulics and pneumatics offer industrial applications.

- Industry trends driving further technological developments for fluid power systems.

- Long-term opportunities for fluid power in industrial applications.

Hydraulics and pneumatics are integral to the operation of a wide range of industrial applications from injection molding and packaging machinery to food production and electronics manufacturing.

Even as electric alternatives make their way into this sector, fluid power systems remain an important technology of choice for many applications. Almost 99% of respondents to a recent Power & Motion survey indicated as such, and nearly half said they are seeing equal use of hydraulics and pneumatics in industrial applications.

As Andrew Aurand, Director of Sales & Marketing at Clippard, stated in an interview with Power & Motion, “Hydraulics and pneumatics remain fundamentally important and, in many cases, the superior choice for industrial automation. The core value proposition of fluid power is undeniable: it offers an unmatched combination of high power density, robustness, and cost-effectiveness.”

Regarding the use of hydraulics in industrial applications, Cindy Cookson, VP & GM, Fluid Power Americas at Gates Corp., said, “A single hydraulic pump can drive multiple actuators, which is far more cost-effective than complex electric systems.”

Meanwhile, pneumatics is the preferred choice for applications in which simplicity, reliability, speed, and cost-effectiveness are critical noted Shalom Kundan, Division Marketing Manager at Parker Hannifin.

The results of our reader survey and discussions with members of the fluid power industry highlight the many trends shaping the sector as well as the continued opportunities for hydraulics and pneumatics in industrial applications.

What is an industrial application?

The applications in which fluid power systems are utilized are typically categorized as mobile or industrial. Mobile applications typically refer to construction equipment, agricultural machinery and other machines that move. Industrial applications, on the other hand, are more stationary such as machinery used to manufacture or process goods.

Features and Trends Driving Industrial Fluid Power Designs

In addition to the basic capabilities hydraulics and pneumatics offer, such as force and speed, there are a number of other features customers in the industrial sector desire from their fluid power technologies.

As shown in the graph below, the majority of respondents to Power & Motion’s survey said they are looking for a combination of improved precision, energy efficiency and increased power density.

The next most popular response was increased power density — the ability to provide more power in a smaller package. Power density is one of the capability improvements for industrial fluid power applications identified by the National Fluid Power Association (NFPA) as well. In a recent report highlighting these capability improvements, the NFPA noted providing more power without increasing the size of a component or system helps meet industrial machinery manufacturers’ requirement for efficient and compact solutions.

While just 11% of survey respondents indicated energy efficiency as a key factor desired by customers in industrial applications, several fluid power industry members noted it as an important feature they see customers requesting. Clippard’s Aurand noted that rising energy costs and sustainability initiatives have made customers highly focused on using energy efficient solutions.

There are numerous ways efficiency gains are being achieved, such as through the use of low-leakage valves and smart FRLs (filter regulator lubricator) noted Kundan.

Jacob Paso, President of Delta Motion, said that efficiency requirements have been driving many to increase their use of direct-drive cylinder control, where a servomotor drives a hydraulic pump that directly controls the cylinder, instead of using a servo or proportional valve. However, he noted these systems are not a good fit for every application. “A motor and pump don’t respond as quickly as a valve and the systems generally have more hysteresis.

“More often, direct-drive control is being used in HPUs (hydraulic power units) with a servo or variable frequency drive (VFD)-controlled motor driving a fixed-displacement pump, providing some energy savings over a swash-plate pump,” he said.

Although sustainability is a factor prompting the use of more efficient technologies, more often it is about reducing operational costs. The less energy it takes to power a system and the machine in which it is used, the less electricity required, and thus money spent, to run a facility. Utility costs in many parts of the world continue to rise, increasing demand for more efficient technologies.

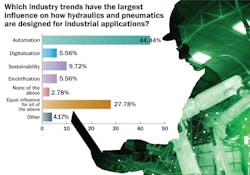

As our reader survey showed, just 10% of respondents indicated sustainability as a trend having the largest influence on hydraulic and pneumatic designs for industrial applications.

Per respondents, automation is the most influential trend. This is not surprising given automation has been increasing in the industrial sector for years to help meet continually growing demand for goods. Parker Hannifin’s Kundan said automation growth is increasing the use of collaborative robots and flexible manufacturing which “requires lighter, modular, and reconfigurable pneumatic systems.”

With increasing levels of automation comes the need for smarter components and systems; the desire for fluid power technologies capable of providing more connectivity and data collection was a key trend pointed to by many of the fluid power industry members we spoke to.

“Information and connectivity are critical — especially for industrial customers operating in high-volume production environments,” said John Fenske, Director of Marketing, Tolomatic. “Having real-time visibility into machine and process performance enables faster, data-driven decisions that optimize productivity and enhance quality.”

Are Electric Options Replacing Hydraulics and Pneumatics?

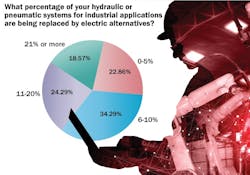

The desire to increase efficiency and automation has driven some industrial applications to replace fluid power solutions with electric options, although as our survey results show alternative technologies are not completely overtaking hydraulics and pneumatics.

Just 19% of survey respondents indicated they are seeing 21% or more of their hydraulic and pneumatic systems being replaced by alternatives like electromechanical actuators (also referred to as electric actuators).

Some of the driving factors for the use of electric alternatives noted by survey respondents include:

- accurate positioning

- lower noise

- ease of installation

- efficiency

- improving capabilities of electric options

- cleaner operation (i.e., no hydraulic oil that may leak from the system)

- better control of speeds and acceleration/deceleration.

Despite the uptake of electric actuators and other alternative technologies in some industrial applications, this does not mean hydraulics and pneumatics will be completely phased out. There are many applications which will continue to rely on fluid power solutions.

“Force density is still a driving factor for fluid power in industrial applications,” said Dan Detweiler, Value Added Systems and Technical Services Manager at Parker Hannifin. “Pure electromechanical solutions still struggle to have the same power and cost ratio for the same space claim in high power machines.”

He said that any application requiring power density and large forces is predominantly going to continue using hydraulics, such as metal forming, high tonnage presses, and mixing in large chemical plants.

Each of the fluid power industry members we spoke to said they are seeing some customers and applications moving to electric alternatives where it makes sense to do so. Detweiler noted medical device machine tools as an example where hydraulics have been replaced by electromechanical systems to eliminate the potential of hydraulic oil contaminating the products being manufactured.

Learn more about the future of hydraulics and pneumatics in industrial applications by reading our Q&A series below offering further insights from the fluid power industry members featured in this article.

Hydraulics and Pneumatics Benefit a Range of Industrial Applications

Industrial Applications Require Smart and Efficient Fluid Power Systems

Opportunities Remain for Industrial Fluid Power Applications

Delta Motion’s Paso said the replacement of fluid power technologies with electric has been a long-term trend. “Many of those [electric options] are good choices, especially where forces are low and there is minimal shock or vibration,” he said. “Unfortunately, some are based on a misunderstanding of technology — in particular, we still run into people that are not aware that very precise position and force control can be done with a modern hydraulic motion controller.”

In addition, he said there can be some misconceptions about the energy savings electric alternatives provide. “Hydraulics can be efficient in holding pressure and handling intermittent high loads. It is important to think of it in terms of energy consumed to produce a certain result rather than simply comparing actuators,” he explained.

Therefore, when determining whether to use a fluid power- or electric-based technology — or possibly even a hybrid of the two — it is important to understand the capabilities, costs and other aspects associated with each to ensure the right one is chosen for a given application.

The Future is Bright for Industrial Fluid Power Technologies

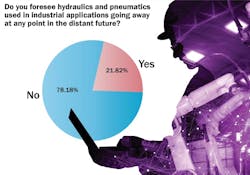

The majority of survey respondents indicated they do not foresee hydraulics and pneumatics disappearing from industrial applications at any point in the distant future.

For those who do see them eventually being replaced, reduced costs associated with electric actuators as well as continued improvements in their power density were among the reasons for this that some respondents noted.

All of the fluid power industry members we spoke to — many of whom also develop electric alternatives — agreed there will continue to be a place for hydraulics and pneumatics in industrial applications.

“I've been working in hydraulics for almost 25 years now and I remember even when I started everyone said ‘hydraulics is not going to last forever, everybody wants to switch to electrical.’ But 25 years later there's still plenty of applications where it [hydraulics] really is the best choice,” said Michelle Gladysz, Product Line Manager – MFB Valves, Baguio Industrial Group Site Manager at Moog Industrial Group.

She said the level of power you can get out of hydraulics compared to electric options remains greater which will continue to benefit a lot of applications.

Like others in the fluid power industry, Gladysz continues to see a number of opportunities for further development and use of hydraulics and pneumatics in industrial applications. The overwhelming majority of respondents to our survey, 96%, indicated as such as well.

Opportunities survey respondents noted they see for hydraulics and pneumatics include:

- Better control methods, sealing and regeneration technologies

- More pairing of electric and fluid power technologies

- Embedding sensors into hydraulics and pneumatics

- Adoption of energy-efficient and environmentally friendly solutions.

Many respondents also noted applications where they see continued opportunities for fluid power solutions such as robotics, electric vehicles, aerospace as well as those with high force and power density requirements.

The fluid power industry members we spoke to also see a long life ahead for hydraulics and pneumatics due in part to their unique attributes. As Gates’ Cookson stated, “Hydraulics provide a unique form factor and the ability to move enormous loads efficiently, something electrics simply can’t match at this time. At Gates, we continue to see strong demand for hydraulics in applications where power density and reliability are critical, and we expect that demand to only grow.”

Tolomatic’s Fenske agreed, noting that electrification strategies are becoming more common for industrial applications but that “there are still many applications that require the force density, speed or economics of a hydraulic or pneumatic solution.”

“The future of fluid power is bright, but it is evolving. The opportunity lies not in fighting other technologies, but in intelligent integration,” said Aurand.

Parker’s Shalom summed up well the outlook he and many others in the industry see for pneumatics, and the fluid power sector as a whole, in industrial applications. “Pneumatics remain at the heart of industrial automation, but the way we design, apply, and think about them is rapidly changing,” he said. “As the industry pushes toward smarter, more sustainable, and digitally connected systems, pneumatics is no longer just a utility - they are becoming a strategic enabler of efficiency, flexibility, and safety. In my view, the real opportunity lies in how pneumatics evolves alongside electric and digital technologies to create hybrid solutions that deliver the best of both worlds.”

About the Author

Sara Jensen

Executive Editor, Power & Motion

Sara Jensen is executive editor of Power & Motion, directing expanded coverage into the modern fluid power space, as well as mechatronic and smart technologies. She has over 15 years of publishing experience. Prior to Power & Motion she spent 11 years with a trade publication for engineers of heavy-duty equipment, the last 3 of which were as the editor and brand lead. Over the course of her time in the B2B industry, Sara has gained an extensive knowledge of various heavy-duty equipment industries — including construction, agriculture, mining and on-road trucks —along with the systems and market trends which impact them such as fluid power and electronic motion control technologies.

You can follow Sara and Power & Motion via the following social media handles:

X (formerly Twitter): @TechnlgyEditor and @PowerMotionTech

LinkedIn: @SaraJensen and @Power&Motion

Facebook: @PowerMotionTech