Global Hydraulic Hose Demand to Grow Through 2031

Key Highlights

- Continued demand for hydraulic systems in various end markets will drive growth for hydraulic hoses in the coming years.

- The construction and oil & gas sectors will account for the largest portion of growth for the global hydraulic hose market due to their heavy reliance on hydraulics.

- New material developments and embedded intelligence are among the technology trends expected to influence the hydraulic hose market in the coming years.

Watching a hydraulic press crush metal or stone is a clear demonstration of the immense force that stems from confined hydraulic pressure. The ability to harness that pressure hinges on several components including hydraulic hoses which are the lifeline of many mobile and industrial machinery applications relying on the force and power density hydraulics provide.

Hydraulic hoses are engineered to deliver the pressurized fluids that keep hydraulic systems alive and responsive, enabling them to power various machine functions such as lifting the boom of an excavator or steering a tractor through a farm field.

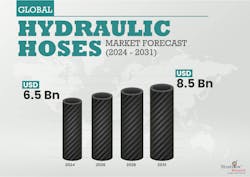

The demand for hydraulic hoses is gradually increasing in conjunction with the rising need for hydraulic systems powering various end-markets including construction, mining and a wide spectrum of industrial machinery. Due to their critical role in various applications, Stratview Research is projecting the global hydraulic hose market will achieve a compound annual growth rate (CAGR) of 4.1% and surpass a value of $8.5 billion by 2031.

Construction & Energy Sectors to Drive Global Demand for Hydraulic Hoses

While hydraulic hoses are used across a wide array of industries including agriculture, manufacturing, and transportation, the construction and oil & gas sectors are expected to account for the largest portion of the global hydraulic hose market’s growth in the coming years owing to their regular use of these hydraulic components.

The construction equipment sector is expanding rapidly — due in part to investments in infrastructure being made around the world — and depends extensively on hoses for one major reason: they power every critical motion of heavy machinery, from lifting and digging to steering and stabilizing.

Not only are hydraulic hoses critical to the functionality of excavators, skid steers, wheel loaders, dump trucks and other construction equipment, but they are also a common failure point. Hydraulic leaks remain a leading cause of construction equipment breakdowns, which are often attributed to hose-related issues.

The harsh operating conditions in which construction equipment is utilized makes the hydraulic hoses in these machines more susceptible to wear and tear, leading to leaks and other performance issues. Any compromise in a hose directly translates to machine downtime, productivity loss, and costly repairs for machine owners. As a result, the frequent need to repair and replace hoses in this sector contributes to global hydraulic hose demand.

In 2024, the construction sector emerged as the largest consumer of hydraulic hoses, generating nearly USD 2.3 billion in demand. With the construction sector poised for growth, global demand for hydraulic hoses from this industry is set to rise accordingly. The Oxford Economics Global Construction Outlook Q2 2025 projects a modest 2.4% dip in global construction activity in 2025, however, a steady recovery and 3.4% expansion is anticipated with the sector reaching a value of $9.8 trillion by 2026.

The oil & gas sector follows construction in global demand, fuelled by the increasing energy needs of a growing population and industrial base. Collectively, construction and oil & gas represent over 55% of global hydraulic hose demand, with the remainder coming from agriculture, manufacturing, mining, and other sectors that utilize hydraulic hoses.

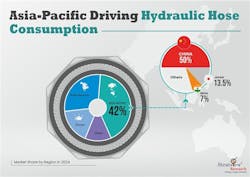

Demand is heavily concentrated in the Asia-Pacific region (APAC) because it hosts the world’s largest construction, agriculture, and industrial activity hubs, particularly in China, India, and Southeast Asia.

These markets deploy massive fleets of excavators, loaders, tractors, mining rigs, and manufacturing equipment, creating continuous replacement cycles for hoses. As a result, APAC’s markets drive over 40% of global hydraulic hoses demand.

Technology Trends Influencing the Hydraulic Hose Market

As demand for hydraulic hoses rises in the coming years, a number of technology trends are expected to impact the design of these components and their use in various markets.

Machine OEMs are moving toward use of higher-pressure, higher-density hydraulic systems to meet compact design and fuel-efficiency demands while at the same time, various industry regulations are tightening requirements on burst protection, leakage, and routing, often increasing thermal exposure. All of this is necessitating developments in new materials and hose designs to meet evolving customer and industry requirements.

Demand for Thermoplastic Hoses on the Rise

Hydraulic hoses are classified into four pressure classes:

- low-pressure (<300 psi),

- medium-pressure (300–3,000 psi),

- high-pressure (3,000–6,000 psi), and

- extremely high-pressure (>6,000 psi).

High-pressure hoses account for more than half of total hydraulic hose consumption because of the large number of applications which require their use.

To handle the higher pressure ratings required in many applications, hoses need to be robust. Their internal structure and the materials used to manufacture them therefore play an instrumental role. The latter is where a number of technological developments are expected to occur in the coming years.

Currently, most hydraulic hoses are still made of elastomer, aka rubber, since this material gives them good flexibility, which is much needed by all industries. However, the demand for thermoplastic hoses is set to rise in the coming years although today thermoplastics hold only roughly 10% of the global market.

Thermoplastic materials are known for their exceptional chemical resistance, light weight, high strength, and good temperature resistance, all of which are desirable traits in various applications. Today, many thermoplastic hydraulic hoses are manufactured using polyoxymethylene (POM), polyamide (PA/Nylon), polyurethane blends, and other materials which enable them to handle pressures of up to 43,510 psi.

While these thermoplastic materials enable hoses to be flexible, they can develop kinking or micro-cracking due to repeated bending under pressure over time, especially in thinner-walled designs. Additionally, their initial high costs create a challenge for wider adoption.

Other specialised materials such as fluoropolymers (PTFE/Teflon) and silicone are also being used in hydraulic hose manufacturing to help them meet a range of design criteria for customers.

The core structure of a hydraulic hose is heavily reinforced to ensure durability. Their internal structure features either wire-braided, spiral-wound, or textile-braided reinforcement; most hoses though are wire-braided because it is able to deliver an optimal balance of pressure handling and flexibility. It also supports tighter bend radii than others, enabling easier routing in compact machinery layouts.

Embedded Technologies Will Lead to Smarter Hydraulic Hoses

As machines become more compact, powerful, and regulation-driven, hydraulic hoses are being exposed to higher pressures, tighter routing, and harsher thermal loads than ever before. With these forces converging, the hydraulic hose has shifted from a replaceable consumable to a mission-critical reliability component, directly influencing machine uptime, safety, and total lifecycle cost.

To address these demands, hoses are increasingly being embedded with technologies such as artificial intelligence (AI), the Internet of Things (IoT), and sensors to enable real-time monitoring and communication with other machine systems. This allows machine owners to track performance and potential maintenance needs, all of which can feed into enabling predictive maintenance capabilities, enhanced safety, and optimized performance.

These smart hoses are not just components, they are becoming enablers of efficiency and reliability, giving growing industries more power and confidence to scale sustainably and optimistically into the future.

This article was written and contributed by Chandana Patnaik, Senior Content Specialist at Stratview Research.

About the Author

Chandana Patnaik

Senior Content Specialist, Stratview Research

Chandana Patnaik is an experienced technical writer, presently serving as a Senior Content Specialist at Stratview Research. She has carved her niche in specific areas including disruptive technologies, information, and specialty chemicals. etc.

She is a regular contributor to various magazines and blogs and writes insightful content that keeps readers stay up-to-date with the latest trends and developments in her areas of expertise.

Leaders relevant to this article: