Expanding Use of Automation Brings Market Opportunities

Key Highlights

- Automation is expanding into more processes thanks in part to advances in robot vision and machine learning.

- Customers are increasingly demanding plug-and-play, integrated motion systems that reduce engineering complexity.

- Future product designs will need to focus on system-level integration, multi-disciplinary collaboration, and smarter, more configurable motion platforms.

Market adoption of automation and robotics continues to grow in various industries, in large part to help overcome the skills gap many are facing.

According to Kyle Thompson, Global Robotic Automation Manager at Thomson, automation is expanding into new areas which is bringing opportunities for those developing the motion technologies utilized in cobots, robots and other automation applications.

He said many customers today are looking for full-system solutions to help ease their adoption of automation and robotics. This is requiring technology providers like Thomson to provide more than just a single component and thus have expertise in various disciplines — mechanical design, electronics, software and more — to ensure solutions meet application requirements.

Power & Motion spoke with Thompson about the continued growth he sees for automation and robotics, how technological needs are evolving because of it, as well as his outlook for the future of the automation industry.

*Editor’s note: Questions and responses have been edited for clarity.

Power & Motion: How was 2025 for Thomson and the industries it serves?

Kyle Thompson: 2025 felt like a year of steady momentum for Thomson and for many of the machine-building, automation and emerging robotics segments we support. Across industries, we are seeing continued investment in productivity, sometimes in big greenfield projects, but just as often in targeted retrofits where manufacturers want clear ROI (return on investment) fast. That suits our role well within Regal Rexnord’s motion control platform, because we help engineers add controlled linear motion and automation capability without overcomplicating the design.

What stands out is that customers aren’t just asking for ‘a component that moves.’ They are trying to solve broader automation problems, reducing the amount of manual handling, increasing utilization of robotic cells, and making equipment more adaptable to changing product mixes. More of these requests are system level, and being part of Regal Rexnord gives us a broader set of motion technologies to draw from. That helps customers solve larger pain points with fewer integration handoffs. So, for us, 2025 has been about meeting those practical needs with solutions that are straightforward to design and easy to integrate into real factory environments.

Power & Motion: What were some of the biggest challenges for the company, or the industries it serves, in 2025?

Kyle Thompson: One of the significant challenges that remains is the skilled labor gap. A lot of our customers are running lean engineering teams, yet they are expected to deliver more complex automation projects on tighter schedules. In parallel, production roles that rely on repetitive manual tasks continue to be difficult to staff and retain, so plants feel pressure to automate even when budgets are constrained.

Another challenge is the hesitation around first-time automation. Many plants want robotic or collaborative systems, but they are hesitant about integration risk, change management, or whether they will truly get utilization out of a new cell. Once they do it and see the benefit, adoption accelerates, but getting to that first successful deployment can take time.

Finally, there is an industry-wide shift in expectations around suppliers. Customers want fewer handoffs and less integration burden. They are looking for partners who understand both the mechanical and control sides of motion systems, not just one part of the stack. That is where our position inside Regal Rexnord adds more value, because we can now support more of the motion system around an automation project and help reduce the engineering burden on the customer.

Power & Motion: And conversely, what opportunities did you see in 2025?

Kyle Thompson: The opportunity is that automation is expanding into processes that used to be considered too variable or too human dependent to automate. Advances in robot vision, often paired with machine-learning tools, are letting manufacturers handle more dynamic part presentations and more diverse product runs. That is opening the door for robotic systems in areas that were previously limited to low-mix, repetitive applications.

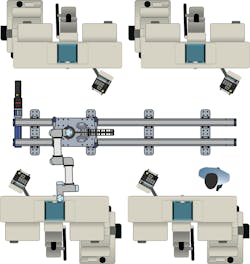

For Thomson specifically, a big opportunity has been helping customers extend what their robots can do. If a plant is investing in a cobot or a robot arm, getting high utilization becomes critical. Adding a seventh axis so that one robot can service multiple stations is a simple concept, but it changes the economics of a cell. We are seeing that mindset ‘how do I get more throughput from the automation I already own?’ drive real projects this year.

We also see opportunities in sectors where automation is becoming essential because the workforce pipeline is shrinking. Welding is a good example. Demand for precision welding is rising, but experienced welders are aging out. That’s creating strong pull for robotic welding systems and the kind of guided, collaborative motion platforms that support them. We expect this to remain a strong application area across Regal Rexnord’s portfolio of brands as well.

Power & Motion: What are the most requested features or capabilities Thomson has been getting from customers over the past year, and how do they fit in with broader trends?

Kyle Thompson: Two themes show up repeatedly. First, customers want integration to feel native. They don’t want to spend months engineering a custom interface between the mechanical motion system, the robot and the controls. The demand is for plug-and-play compatibility with widely used robot brands and control architectures. That aligns with the broader mechatronics trend: automation projects now assume mechanical and software layers will come together cleanly. With complementary motion technologies from Regal Rexnord, Thomson can help customers move from component selection to integrated system design faster.

Second, customers are asking for motion systems that support safe human-robot collaboration. In many factories, robots and people share space, especially in smaller or high-mix environments. Features like collision detection and collaborative behavior aren’t just “nice to have” anymore; they are key to getting a system approved and accepted on the shop floor. This matches the larger trend of cobots moving from niche to mainstream, and of automation being deployed where humans remain part of the workflow.

So overall, the requests are consistent with where the industry is headed — fewer pure component buys, more integrated motion platforms, and more attention to usability and safety in real production settings.

Power & Motion: How has Thomson seen the trend of using electric actuators in place of hydraulic and pneumatic options continue to unfold? Is demand still increasing, and where?

Kyle Thompson: Yes, demand for electric alternatives continues to grow, especially where precision, programmability and cleanliness are priorities. Even in applications that historically leaned on fluid power, engineers are more willing to evaluate electric options when they need tighter motion control, easier feedback, or smoother integration into digital control systems.

We are also seeing this trend accelerate in automation-heavy environments. When a machine builder is already designing around servo-driven systems and networked controls, electric actuation becomes a natural fit. It simplifies the overall architecture — no hoses, no valves to tune, fewer maintenance variables — and it supports the kind of flexible motion profiles that modern automation requires. Within Regal Rexnord, we support customers at the system level, making sure the actuator, drive and supporting motion elements are matched for an optimized electric conversion instead of a simple one-for-one replacement.

The strongest pull is in industrial automation, material handling and robotics-adjacent systems where controlled linear motion needs to coordinate closely with other axes. In those cases, electric actuation isn’t just a replacement; it enables capabilities that would be hard to implement with hydraulic or pneumatic setups.

Power & Motion: Are any new trends emerging in 2026 and beyond, and how might they impact future product designs?

Kyle Thompson: Looking ahead, the most important trend isn’t a single technology, it’s the continued merging of disciplines. Automation projects increasingly require engineers to think across mechanical design, electronics, controls and software from the outset. That pushes suppliers like us to deliver systems that don’t live in isolation but are designed to integrate into a broader control ecosystem. This is exactly the direction Regal Rexnord is investing in across its motion platforms and Thomson’s linear solutions are a key part of that approach.

On the technology side, vision-enabled robotics will keep pushing automation into higher-mix, lower-volume processes. As those systems mature, the motion platforms around them need to be smarter at synchronizing with robot controls, more configurable, and better able to support collaborative safety expectations without complex tuning.

So, for future product design, the implication is clear: motion solutions must be easier to deploy, easier to connect, and more capable of working as part of a multi-axis, multi-vendor automation system. We expect that systems-ready mindset to matter more each year.

Power & Motion: What opportunities do you see in 2026? Any markets you anticipate doing well?

Kyle Thompson: We expect 2026 to be another active year for automation, particularly in applications where manufacturers need to stretch skilled labor and improve asset utilization. Robotics growth will continue, but we think the most interesting opportunity is in expanding what robots can handle, not just adding robots, but enabling them to do more per cell.

Welding automation is one area we expect to stay active. The labor gap there is structural, not cyclical, and manufacturers are moving faster to automate for consistency and throughput. Motion solutions that make welding cells more flexible, collaborative and productive will be in demand. Being part of Regal Rexnord allows us to support these welding and robotics projects more holistically.

Beyond welding, any sector dealing with repetitive handling, inspection or assembly in a high-mix environment is likely to invest. As factories look for practical steps toward modernization, solutions that combine reliable linear motion with straightforward robot and controls integration will be well positioned. That is exactly the space we are focused on supporting.

About the Author

Sara Jensen

Executive Editor, Power & Motion

Sara Jensen is executive editor of Power & Motion, directing expanded coverage into the modern fluid power space, as well as mechatronic and smart technologies. She has over 15 years of publishing experience. Prior to Power & Motion she spent 11 years with a trade publication for engineers of heavy-duty equipment, the last 3 of which were as the editor and brand lead. Over the course of her time in the B2B industry, Sara has gained an extensive knowledge of various heavy-duty equipment industries — including construction, agriculture, mining and on-road trucks —along with the systems and market trends which impact them such as fluid power and electronic motion control technologies.

You can follow Sara and Power & Motion via the following social media handles:

X (formerly Twitter): @TechnlgyEditor and @PowerMotionTech

LinkedIn: @SaraJensen and @Power&Motion

Facebook: @PowerMotionTech