Why Pneumatics are a Good Fit for Semiconductor Production

What you’ll learn:

- The benefits of using pneumatics for semiconductor manufacturing.

- How pneumatic technology is utilized for the production of semiconductors.

- Continued opportunities for pneumatics in the semiconductor industry.

Semiconductors can now be found in just about every electronic device, vehicle and machine as more applications move into the digital world. As their use continues to grow, so too does the need to manufacture them, providing opportunities for the various technologies involved in producing these chips such as pneumatics.

“Pneumatics is kind of hidden in the industry, but it actually plays a really significant role in the automation of the semiconductor industry,” said Damon Turley, Festo Industry Segment Manager for Semiconductors, in an interview with Power & Motion. “With pneumatics, we can provide a clean, reliable and precise motion control solution.”

As Turley explained, delicate movements are often required “and we’re actually able to do that really well with pneumatics.”

Robert Dickman, UTC Senior Engineering Manager at SMC Corp., told Power & Motion that pneumatics offer speed and simplicity. Pneumatics provide faster cycle times, simple on and off controls, and ease of maintenance, all of which make the technology a good fit for manufacturing semiconductors.

He also noted the clean operation pneumatic systems provide as well as the fact these systems are typically a cost-effective option, further benefiting their use in the semiconductor industry.

The Benefits of Using Pneumatics to Produce Semiconductors

Turley said pneumatic technologies are an excellent choice for the various applications within the semiconductor industry. Many of these applications need to be air piloted, which pneumatic controls offer.

“The ability to precisely control the compressed air is a really important factor to the industry,” he said.

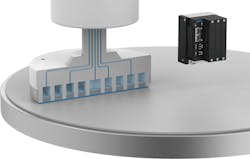

Precision is key for semiconductor manufacturing to ensure a quality product that performs as desired is created time after time. Integration of electronics into pneumatic components such as Festo’s VTEP proportional valve terminal enable this precision to be achieved.

VTEP uses the company’s Controlled Pneumatics, a piezoelectric-based technology enabling closed-loop control of air, for applications such as wafer production. This ensures the valve terminal can precisely control polishing, handling and other tasks related to the production of semiconductor wafers. As these are very delicate components, a high level of precision is required to guarantee they are handled with care to minimize damage and thus product quality issues.

Determining which technologies to utilize for semiconductor production, pneumatic or otherwise, depends upon the operational requirements. Turley said it is important to prioritize the solution that is needed and ask questions such as:

- How precise is the application?

- How clean is the application?’

- Is reliability the most important factor?

- How smooth and controlled does the application need to be?

If an application requires a high degree of cleanliness, for instance, pneumatics is likely a good fit because of the clean operation this technology provides. There is no oil as you’d have with hydraulics, so there is no fear of contaminating sensitive electronics should a leak or other issue occur.

Another important factor to consider said Turley is how much space is available for a production system. “Sometimes the space is very limited, and pneumatics offer a good solution for small spaces,” he said.

SMC’s Dickman agreed that the compact size of pneumatic systems can benefit their use in semiconductor production applications. He noted that electric actuation alternatives tend to have a more elaborate system setup than pneumatics with a lot of electrical components and controls, requiring more space than what may be available.

Turley added that the cost of space is very high in semiconductor manufacturing. “It’s about making products smaller and smarter,” he said. “From a pneumatic standpoint, [the technology] fits into that well.”

By continuing to develop products which are smaller in size and offer better control capabilities, Festo aims to help customers in the semiconductor industry achieve more in a smaller footprint.

Watch Festo's video below to see how its pneumatics technology can provide gentle handling of wafers during the semiconductor production process.

Precise Flow Control Reduces Waste

One of the applications Turley said Festo’s pneumatics technology has proved beneficial is for Front Opening Unified Pods (FOUPs) purge systems which are used to securely transport semiconductor wafers in an oxygen- and particle-free environment from one manufacturing step to the next.

Nitrogen gas (N2) is used to keep oxygen and particles out of the FOUP system; Festo has developed an N2 flow control system which utilizes the company’s piezo-based technology. “We have the ability to precisely meter the amount of nitrogen that goes [into the system],” he said.

This enables semiconductor fabrication plants (Fabs) to better manage and potentially even reduce the amount of nitrogen they use, leading to cost and emissions savings. “Nitrogen is not cheap and it's also not good for the environment,” said Turley. “So, using smaller amounts of nitrogen…and putting in the exact amount needed is one of the unique things that we're able to do.”

Festo’s flow control technology reduces N2 flow from 20 nl/min to 5 nl/min per FOUP, helping lower energy costs and carbon emissions. The company has released a white paper detailing research it undertook which demonstrates highlights the savings potential possible for Fabs when they utilize precision control systems in their operations.

Semiconductors to Remain a Growth Area for Pneumatics

Turley said the semiconductor industry represents a significant growth opportunity going forward for pneumatics. He noted that the market is expected to double in the next 5-7 years and is being driven by rising use of artificial intelligence (AI), big data and other digital technologies.

The Semiconductor Industry Association’s (SIA) 2025 State of the U.S. Semiconductor Industry report states that global semiconductor sales reached $630.5 billion in 2024 and were well above 2023 figures due to increased demand for AI, automotive and industrial applications. SIA notes in its report that the World Semiconductor Trade Statistics (WSTS) project is estimating worldwide semiconductor industry sales will increase 11% in 2025, reaching a value of $701 billion.

The association anticipates further growth for the semiconductor market over the next decade as sectors relying on chips such as AI, electric and autonomous vehicles, and advanced manufacturing continue to grow as well.

Semiconductors an Opportunity Market for the Fluid Power Industry

Global investments in semiconductor manufacturing facilities are increasing to meet rising global demand for these devices. The U.S. is one of the regions where investments are particularly high at the moment as the country looks to boost domestic production. Facilities that received funding through the CHIPS Act are starting to come online and further incentives have been introduced by the federal government to help spur the construction of more manufacturing facilities, including semiconductor production plants.

These investments will benefit both segments of the fluid power industry. Pneumatic valves and other components provide a compact as well as precise option for applications such as wafer handling. Meanwhile, hydraulic components like quick connect couplings are important to the functionality of the liquid cooling systems utilized at many semiconductor production facilities.

Therefore, continued growth in the semiconductor industry is viewed as an opportunity market for the fluid power sector in the years ahead.

All of this anticipated growth for the semiconductor market means there will be a need to produce more chips, necessitating demand for the technology which produces them as well.

Turley believes this will provide opportunities for the pneumatics industry not only in terms of demand but also new technological developments. As the semiconductor industry continues to evolve, there will be a need for manufacturing smaller nodes and more effective power management systems. “It opens up a lot of new opportunities, and challenges, for the industry,” he said. “We can work on better solutions for that; Festo is poised to help [by providing] special products and solutions for the [semiconductor] industry.

“When we're looking at the next few years in development of new equipment for the semiconductor industry, I think it's vital that more technology goes into pneumatics, [such as] a valve manifold, to make it more capable and [able to] handle applications with more precision than previously thought possible,” he concluded.

About the Author

Sara Jensen

Executive Editor, Power & Motion

Sara Jensen is executive editor of Power & Motion, directing expanded coverage into the modern fluid power space, as well as mechatronic and smart technologies. She has over 15 years of publishing experience. Prior to Power & Motion she spent 11 years with a trade publication for engineers of heavy-duty equipment, the last 3 of which were as the editor and brand lead. Over the course of her time in the B2B industry, Sara has gained an extensive knowledge of various heavy-duty equipment industries — including construction, agriculture, mining and on-road trucks —along with the systems and market trends which impact them such as fluid power and electronic motion control technologies.

You can follow Sara and Power & Motion via the following social media handles:

X (formerly Twitter): @TechnlgyEditor and @PowerMotionTech

LinkedIn: @SaraJensen and @Power&Motion

Facebook: @PowerMotionTech

Leaders relevant to this article: