Construction Equipment Market Builds

“There can be no doubt that 2015 was a tough year for the global equipment industry, due to slowing world economic growth and weak commodity prices,” says Off-Highway Research managing director David Phillips. “Unit sales fell to their lowest since the crisis years and the drop in the Chinese market was particularly brutal. However, there were improvements in several developed countries, which helped offset some of these losses.”

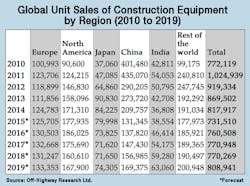

The gradual improvement in Europe, which began in 2014, is expected to continue this year, with unit sales increasing from a provisional 125,705 units in 2015 to 130,503 machines. Similarly, the North American market should rise a further 4% to 186,025 machines. Continued steady improvements are expected in the Indian construction equipment market, with unit sales expected to rise to 46,414 machines, compared to 38,554 in 2015. Meanwhile, in China, the market is expected to show an uptick of around 4%, with sales stabilizing at 137,820 units.In Japan, construction equipment sales are expected to fall from 79,998 units in 2015 to 73,825 machines in 2016. The key drivers of this are a tailing-off of reconstruction work following the 2011 earthquake and tsunami and the winding down of the government’s economic stimulus programs.

Phillips says, “Off-Highway Research’s forecast is for the start of a gradual return to health in the global construction equipment market in 2016. However, as has been the case since the crisis years of 2008 and 2009, business confidence remains fragile, and the uncertain geopolitical outlook around the world could have a negative impact on the sector.”

Off-Highway Research will be exhibiting at Bauma 2016, in Munich from April 11 to 17, Hall B5, Stand 227/B. The firm will present updated forecasts for the global industry across its Chinese, European, and Indian subscription services, its Chinese, Indian, and International databases, and the global Volume & Value service.