Steady Growth Expected for Motion Controls Market

The global motion controls market is expected to be worth $18.9 billion in 2023 according to the latest data from research firm Interact Analysis. This will be an increase from the $17.7 billion the market was worth in 2022.

Steady growth is anticipated for the motion controls industry going forward after the high demand experienced in 2021/2022 due to strong demand from the consumer products sector which drove increased investment in automation – a prime user of many motion controls technologies.

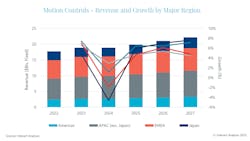

While the Asia-Pacific (APAC) region is the largest market for motion controls, Interact Analysis reports the Americas will bring the highest levels of growth in 2023 at 7.4%.

The research firm is predicting a decline in global growth of motion controls in 2024 but a return to steady growth levels in the mid- and long-term.

Key Drivers for Motion Control Market Growth

Continued investments in automation from the manufacturing sector will help drive growth for the motion controls market. Motion control is a key element of automation by bringing together components to enable controlled movement, leading to improved productivity and efficiency (see sidebar below).

In its motion controls market report, Interact Analysis notes that in 2022 the APAC region, particularly China, was the largest for the sector, accounting for 37% of global revenues, followed by Europe, the Middle East and Africa (EMEA) at 33%. Japan accounted for 16% of the global market and the Americas 14%.

The Americas should see a greater share of the global revenues in 2023 as investments in manufacturing remain high in the region due to re- and nearshoring efforts — which includes the building of new facilities as well as integration of more advanced technologies such as automation.

Semiconductors and electronics, which are large markets for use of motion controls, will benefit from the CHIPS and Science Act in the U.S., said Interact Analysis and thus aid with the motion controls industry's continued strength in the region.

READ MORE: How the CHIPS and Science Act Will Benefit Fluid Power and Motion Control Manufacturers

In speaking with some vendors in the market, Interact Analysis said some are optimistic and anticipate growth rates as high as 20% in 2023. However, there are others who are less so and foresee a flat year compared to 2022.

High interest rates and inflation are factors somewhat mitigating investments in automation. The anticipated economic downturn predicted by ITR Economics and others in 2024 — a mild industrial sector downturn starting at the end of 2023 — is also factoring into some manufacturers' less than optimistic outlook.

Despite this slight downturn, overall the motion controls market is expected to see steady growth in the coming years. Investments in industrial automation will play a key role in this as the manufacturing sector looks to improve its productivity to meet ever increasing demand for products and overcome labor challenges.

Interact Analysis said the motion controls market will achieve a compound annual growth rate (CAGR) of 4.6% through 2027, reaching a value of $22.2 billion. Japan will likely see the largest drop in growth of all global regions during the 2024 economic turndown but then experience the strongest recovery with a growth rate of 6.9% through 2027.

Emerging Technology Areas for Motion Control Systems

While industrial machinery is a key segment for motion control technologies, their use in other applications is rising which should benefit further market growth in the coming years.

According to Interact Analysis, machine tools and semiconductor machinery makers are the largest users of motion controls with the metal cutting machinery sector accounting for the largest segment in 2021. Additional applications making use of motion control include packaging machinery, industrial robots and metal forming machinery.

These applications will continue to be strong use sectors for motion control, but as Interact Analysis reports, there is growing demand from other sectors as well. Mobile robots in particular have become a growth area for motion controls due in part to their need for precise motion and the rise in e-commerce increasing the need for more warehouse automation.

READ MORE: Autonomous Mobile Robots on an Upward Trajectory

Interact Analysis projects sales of motion control technologies into the mobile robot industry to achieve a CAGR of 52.0% through 2026. By that point, it predicts there being close to 1,000,000 mobile robots produced each year, leading to strong growth potential for motion controls.

Sales of motion controls to the textiles machinery industry will be the next largest application segment with a CAGR of 5.7% followed by the material handling equipment sector at 5.6%.

As use of motion controls grows in these and other markets, and efforts to implement automation in the manufacturing sector, continue, developers of these components should fair well in the coming years.

What is motion control?

Motion control is typically seen as a sub-field of automation and the movement of parts in a controlled manner.

As explained by A3 - Association for Advancing Automation, it is a term used to describe how individual components work together to create controlled movement within a machine. The three main components which comprise a motion control system include:

- controller

- motor drive

- motor which could be stepper or servo motors or linear actuators.

Sensors, cabling and other sub-components are included as well to ensure optimal machine part movements.

About the Author

Sara Jensen

Executive Editor, Power & Motion

Sara Jensen is executive editor of Power & Motion, directing expanded coverage into the modern fluid power space, as well as mechatronic and smart technologies. She has over 15 years of publishing experience. Prior to Power & Motion she spent 11 years with a trade publication for engineers of heavy-duty equipment, the last 3 of which were as the editor and brand lead. Over the course of her time in the B2B industry, Sara has gained an extensive knowledge of various heavy-duty equipment industries — including construction, agriculture, mining and on-road trucks —along with the systems and market trends which impact them such as fluid power and electronic motion control technologies.

You can follow Sara and Power & Motion via the following social media handles:

X (formerly Twitter): @TechnlgyEditor and @PowerMotionTech

LinkedIn: @SaraJensen and @Power&Motion

Facebook: @PowerMotionTech

Leaders relevant to this article: