Electric Vehicle Development to Grow Over Next Decade

To say electrification is on the rise these days may seem like an obvious statement to make, but certainly not one which can be ignored. Almost every industry from construction equipment to fluid power to lawn equipment is going electric.

While there are still many challenges associated with electrification—particularly for vehicles and mobile equipment—such as charging infrastructure and grid capacity, it is currently seen as one of the key methods for reducing global emissions.

Developments in electric vehicles of various sizes and types have picked up in recent years for a variety of reasons. A major reason is the reduced cost of batteries as well as improvements in their design and chemistries. Advancements in other necessary components such as electric motors, e-axles and others have also benefited manufacturers’ ability to develop more electric vehicle options.

Rising fuel prices, more technology improvements, increased efforts to reduce emissions and other benefits provided by the use of electric vehicles—reduced maintenance and improved efficiency among them—will help drive the market for electrification for the next several years. And as electrification grows, so too will the impact on other related sectors and component manufacturers such as those working in fluid power and motion control.

Passenger Car Electrification to Grow Through 2027

The automotive market has seen a large push toward electrification in recent years. It has grown such that even pickups are now going electric, and manufacturers like General Motors (GM) have announced plans to increase their electric vehicle (EV) sales in the coming years. GM has said it plans to offer 30 new EV models globally by 2025.

And GM is not alone. A recent electric vehicle market report from Meticulous Research indicates a compound annual growth rate (CAGR) of 33.6% will be achieved in the EV automotive market through 2027. By 2027, the research firm projects a market value of $2,495.4 billion and 233.9 million vehicle units produced to achieve a CAGR of 21.7% from 2020 figures.

Meticulous Research lists the following reasons in its press release announcing the release of its report as some of the key factors driving EV growth -

- Supportive government policies and regulations,

- Increasing investments by leading automotive OEMs,

- Rising environmental concerns,

- Decreasing prices of batteries

- Advancements in charging system technologies.

Additional drivers include a rise in EV adoption in emerging economies and the growth of autonomous vehicles. The research firm does note the lack of charging infrastructure in these markets will pose challenging, just as it is in many areas of the world currently.

While the COVID-19 pandemic did impact global supply chains which has lead to production disruptions in the automotive market, including for EVs, Meticulous Research says there will be relatively quick recovery for the EV segment due to strong recovery and demand in China. Europe and China are both projected to see strong recovery for their EV markets, but the U.S. is expected to lag behind. Whether this will change due to the high fuel prices seen due to the conflict between Russia and Ukraine remains to be seen.

Read more from our colleagues at Oil & Gas Journal in “Oil prices soaring on Russia-Ukraine conflict.”

Aggressive government initiatives in Europe and China are expected to help stabilize the EV industry in those regions notes Meticulous Research. It projects Europe will record the highest CAGR of 35.7% by value and 23.3% by volume during the forecast period. This will be due to increasingly stringent emissions regulations and available charging networks.

China recorded the largest number of EV sales in 2021, aided by strong support from the government for uptake of these vehicle types. The market will growth further as government efforts continue increasing and drive sales up to 25% of the automotive market by 2025 says Meticulous Research.

Vehicles with a power output in the range of 100-250 kW is expected to see the highest growth through 2027. This is due to the rapid growth taking place in heavier duty vehicle segments such as buses and trucks.

Electric Medium- and Heavy-Duty Trucks to Become Cost Competitive by 2035

Electrification has picked up steam in the commercial vehicle space with manufacturers looking to electrify everything from shuttle buses to delivery vans to school buses and Class 8 trucks. Like automotive, charging time and infrastructure needs are a large hurdle for this market.

As our colleagues at Fleet Owner reported, news from the recent Work Truck Week was dominated by electric vehicle technologies.

Applications like school buses where the vehicles go back to a home base at which charging infrastructure can be installed or those making frequent stops throughout the day and able to make use of regenerative braking are so far best use cases for electrification. Long-haul trucking, however, has more of a challenge as there is no nationwide charging infrastructure for these vehicles in the U.S. or other countries. This is being worked on in many places around the world but will pose challenging for some time.

Several major OEMs such as Daimler and Volvo are working to help develop charging infrastructure for larger trucks as they also see the need, and know it is a necessary component to increase market uptake of EVs.

Despite the challenges, electrification will continue to grow in this market. TRATON GROUP—parent company of commercial vehicle brands including Scania and Navistar—announced on March 16 it plans to increase its investments in alternative energy technologies for commercial vehicles. The company says it will invest €2.6 billion in electric mobility research and development by 2026; previously the company planned to invest 1.6 billion euro by 2025.The company believes pure electric trucks are the most advantageous and will be prioritizing its development efforts in this area. CEO Christian Levin says the goal is for 50% of the group’s long-haul trucks to be zero-emission vehicles by 2030, assuming regulatory measures and charging infrastructure are in place.

The U.S. Dept. of Energy (DOE) has released a new study which shows that by 2030 close to half of the available medium- and heavy-duty trucks will be cheaper to buy, operate and maintain as zero-emissions vehicles than if they were powered by diesel engines. This will be due to ongoing improvements in zero-emission and fuel technologies.

Smaller battery-electric trucks are expected to be cost competitive before 2030, the study finds, and heavy trucks which have a range under 500 miles will become cost competitive by 2035.

The DOE says money included in the Bipartisan Infrastructure law will aid battery supply chains over the next 5 years, which is expected to help the EV market. Funds are also allocated for building up the U.S.’s charging network, further benefiting the market. The DOE notes guidance for the infrastructure law was recently sent to states and includes support for truck charging infrastructure.

Knowing battery technology is not a completely green technology, the DOE has also recently released two notices of intent for battery recycling and second life applications. This can help to find other uses or better recycling for electric drive batteries once they are past their useful life in an EV. Grid storage is one of the many areas under investigation for possible second life applications. Funding will also go toward battery materials processing and manufacturing to help improve those aspects of the battery life cycle as well.

The DOE has several initiatives under way to aid with development of cleaner operating heavy vehicles such as the SuperTruck 3 program and Million Mile Fuel Cell Truck consortium.

Electric Construction Equipment Market to Grow 25.6%

Although the off-highway equipment sector is not one that immediately comes to mind for many when thinking of electrification, use of electric power in this market is just as important. And in applications like mining—particularly underground mining where reducing emissions is vital to workers’ health and safety—the use of electric power systems is nothing new. But it has certainly been advancing more in this segment in recent years.

And other heavy equipment applications such as construction and agriculture are following suit. Volvo Construction Equipment currently has five compact electric machines available. CASE Construction Equipment recently unveiled its newest electric machine, the CX15 EV mini excavator. Danfoss’ Editron division also recently worked with Doosan to supply electric motors and other components for use in new 16- and 30-ton electric excavators.

READ MORE: New Electric-Powered Excavators Show Continued Industry Momentum Toward Electrification

According to research firm IDTechEx, construction equipment is projected to produce close to 400 Mt of carbon dioxide (CO2) emissions per year which equates to about 1.1% of global CO2 emissions. With the sector contributing such a high level of emissions, IDTechEx says decarbonization of these machines through new technologies like electrification will be necessary to help curb overall global emissions output.In addition, many cities and countries are targeting net-zero carbon futures, requiring a change to the power sources for vehicles and machines of all types.

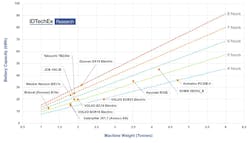

IDTechEx notes in its press release discussing the results of its latest report “Electric Vehicles in Construction 2022-2042”, that many construction equipment manufacturers and component suppliers realize the need to transition to alternative power sources.

As can be seen by what’s currently available in the market, compact machines will be the starting point for this industry. This is due to their often-lighter duty cycles which require less energy use. Battery sizes can be smaller; component and charging needs are lower than what will be necessary for larger machines, depending on the application.

IDTechEx states excavators over 10-tonnes are responsible for around 46% of the total CO2 emissions by construction equipment, making it vital to find alternative solutions for this machine type. Electrification of machines over 20-tonnes would require more than 300 kWh of energy for an 8-hour workday.

Hybridization is seen as an immediate term option for larger machines. This would allow smaller batteries to be utilized and solutions like energy recuperation could be utilized to help power functions of the machine.

Other solutions are also being investigated for larger machines such as battery swapping—commonly used for electric powered underground mining equipment—and cable operation.

This sector will also need to determine how best to charge these machines as well as the cost benefit to customers. For smaller machines, IDTechEx believes the slight increase in cost for electric versus diesel will be modest enough. The reduced fuel costs and maintenance which come with electric machines will provide enough savings to offset the extra initial cost of the equipment. Currently, larger machines are seen as being less cost prohibitive and OEMs as well as customers will likely need regulatory and financial support to aid market uptake.

While there are many challenges yet to overcome with electric construction equipment, the industry sees enough benefits to continue investing in this technology. IDTechEx forecasts the global electric construction equipment market will achieve a CAGR of 25.6% by 2042, reaching a value of $105 billion.

About the Author

Sara Jensen

Executive Editor, Power & Motion

Sara Jensen is executive editor of Power & Motion, directing expanded coverage into the modern fluid power space, as well as mechatronic and smart technologies. She has over 15 years of publishing experience. Prior to Power & Motion she spent 11 years with a trade publication for engineers of heavy-duty equipment, the last 3 of which were as the editor and brand lead. Over the course of her time in the B2B industry, Sara has gained an extensive knowledge of various heavy-duty equipment industries — including construction, agriculture, mining and on-road trucks —along with the systems and market trends which impact them such as fluid power and electronic motion control technologies.

You can follow Sara and Power & Motion via the following social media handles:

X (formerly Twitter): @TechnlgyEditor and @PowerMotionTech

LinkedIn: @SaraJensen and @Power&Motion

Facebook: @PowerMotionTech

Leaders relevant to this article: