Fluid Power Shipments Rise in March 2025

The newest shipments and order data from the National Fluid Power Association (NFPA) shows total fluid power shipments increased 12.6% in March 2025 compared to the previous month. This comes after several months of reported declines, providing a potential sign of positivity for the hydraulics and pneumatics sector.

However, NFPA’s data shows total fluid power shipments in March 2025 were 6.1% below those recorded in March 2024. Here again the data may be showing some semblance of positivity as this decline is less than the 14% decrease reported in February 2025 compared to a year ago.

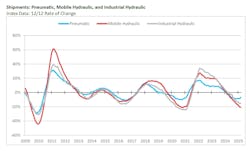

The 3/12 and 12/12 rates of change for total fluid power, hydraulic, and pneumatic shipments are negative, although NFPA notes their downward movement appears to be plateauing.

Mixed Results for Hydraulics and Pneumatics in the First Quarter

March’s uptick in fluid power shipments may correlate to some of the initial positivity seen at the start of the year in some markets such as metalworking machinery which saw a rise in new orders in January and February according to the Association for Manufacturing Technology (AMT). However, in March manufacturing activity began to contract, and business confidence started to decline.

The first quarter of 2025 appears to be a bit of a mixed bag with some markets experiencing a positive start to the year but others not as much.

As the two graphs below show, shipments and orders for pneumatic, mobile hydraulic and industrial hydraulic products were mostly down in the first quarter of 2025. This was seen in the data reported by NFPA in both January and February as well.

First quarter financial reports from fluid power companies and those in their various customer markets demonstrate a similar situation. Helios Technologies, for instance, released its first quarter 2025 results on May 6 which show sales were down 8% compared to the prior year but up 9% from fourth quarter 2024. The company noted that slight growth in the health and wellness and recreational markets helped to offset declines in industrial and mobile markets for its electronics segment, which saw just a 1% drop in revenue during the quarter.

Its hydraulics business though was down 11% due to weakness in the industrial sector as well as agriculture and other mobile machinery markets.

The Association of Equipment Manufacturers’ (AEM) tractor and combine report for March 2025 shows the difficult market conditions the agricultural equipment industry continued to face during the quarter. While Canadian sales for tractors and combines rose during the month, sales for both machine types in the U.S. dipped again in March. Sales in the U.S. were down in January and February as well per AEM.

Uncertainty about tariffs and the overall agriculture economy were noted reasons for the decline in U.S. sales of agricultural machinery by AEM Senior Vice President Curt Blades.

Gain More Market Insights

For even more economic and market trends information for the fluid power industry, visit our State of the Industry page. There you'll find video interviews, articles and more overviewing current and future market information as well as insights on how these trends could impact hydraulic and pneumatic system designs.

Sean Bagan, President, Chief Executive Officer and Chief Financial Officer of Helios Technologies, also mentioned the challenges tariffs are presenting by creating uncertainty for the second half of 2025. He said the company’s “in the region for the region” manufacturing strategy is helping to navigate the tariff landscape by producing what it can locally.

“While markets remain persistently weak, we are starting to see some positive trends forming in the order intake over the last several months,” said Bagan. “We have been selective with our capital expenditures and continue to be disciplined with cost control measures. These factors provide us a level of confidence in our next quarter projections. Markets could quickly shift and we are staying nimble and very close to our customers as we navigate through this unprecedented tariff environment together.”

The uncertainty tariffs have created — due to their implementation, amounts and trading partners affected changing frequently — is making business planning difficult for companies, causing many to hold off on making major capital investments. As such, demand for industrial and mobile machinery has been more subdued during the first quarter, leading to many economic and market intelligence firms to revise their outlooks for 2025.

For now, it will be a wait-and-see game to see how the rest of the year, and potential trade policies, will pan out for the fluid power industry and its customer markets.

The charts in this article are supplied by NFPA and drawn from data collected from more than 70 manufacturers of fluid power products by NFPA’s Confidential Shipment Statistics (CSS) program.

About the Author

Sara Jensen

Executive Editor, Power & Motion

Sara Jensen is executive editor of Power & Motion, directing expanded coverage into the modern fluid power space, as well as mechatronic and smart technologies. She has over 15 years of publishing experience. Prior to Power & Motion she spent 11 years with a trade publication for engineers of heavy-duty equipment, the last 3 of which were as the editor and brand lead. Over the course of her time in the B2B industry, Sara has gained an extensive knowledge of various heavy-duty equipment industries — including construction, agriculture, mining and on-road trucks —along with the systems and market trends which impact them such as fluid power and electronic motion control technologies.

You can follow Sara and Power & Motion via the following social media handles:

X (formerly Twitter): @TechnlgyEditor and @PowerMotionTech

LinkedIn: @SaraJensen and @Power&Motion

Facebook: @PowerMotionTech

Leaders relevant to this article: