Fluid Power Shipments Contract in August 2025

The National Fluid Power Association (NFP) has published its latest orders and shipments data for fluid power products. Per the data, shipments for total fluid power, total pneumatic, and total hydraulic contracted on a month-over-month basis in August 2025.

Total fluid power shipments in August were down 8% from those recorded in August 2024 as well. This comes after similar declines in July 2025, demonstrating the continued challenges the fluid power industry and its customer markets have faced this year due in part to headwinds such as high interest rates and tariffs.

While total fluid power shipments were down during the month, NFPA's data shows the 3/12 rate of change for total hydraulics shipments have been trending more positively over the last 6 months. The assocation notes total mobile hydraulic shipments have been dragging down total hydraulic shipments, evidence the mobile machinery industry continues to face market challenges.

Agricultural equipment, one of the largest customer segements for the fluid power industry, particularly mobile hydraulics, is one such sector that has struggled in 2025. For much of the year, the monthly U.S. and Canadian Tractor and Combine reports from the Association of Equipment Manufacturers (AEM) have shown declines for much of the year.

However, Canadian sales have picked up in recent months, with AEM reporting August combine sales rose 52.2% and further sales gains were seen for both combines and tractors in September 2025.

September also saw a rise in U.S. sales for tractors, indicating some potential positivity for this machinery market and those who supply it.

Get More Market Information

For even more economic and market trends information for the fluid power industry, visit our State of the Industry page where you'll find video interviews, articles and more overviewing current and future market information.

You can also sign up for our monthly Market Trends newsletter to have economic and technology trend insights sent directly to your inbox.

Curt Blades, Senior Vice President at the Association of Equipment Manufacturers, said the modest increase in U.S. tractor sales in September is encouraging. "Although there is some uncertainty and volatility in the marketplace, we are optimistic this positive trend will continue, particularly as the harvest season progresses."

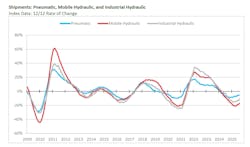

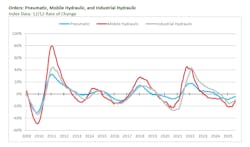

The next two charts provide a snapshot of how shipments and orders for pneumatics, mobile hydraulics and industrial hydraulics performed in August 2025.

As the shipments chart shows, the 12/12 rate of change for pneumatics and industrial hydraulics remained above that of mobile hydraulics. Industrial applications such as general manufacturing, semiconductors, and food & beverage production have experienced slightly better market conditions in 2025 than their mobile counterparts.

In the first few months of the year, industrial machinery saw increases in demand and some segments have continued to fare better than others, aiding activity in the pneumatic and industrial hydraulics sectors of the fluid power industry.

Orders showed a similar picture in August 2025 with pneumatics and industrial hydraulics performing better than mobile hydraulics. However, the trend line for mobile hydraulics is getting closer to that of industrial hydraulics, indicating there could be some positive momentum starting in this segment of the fluid power industry.

It is also possible that market conditions for industrial segments may be shifting. The Association for Manufacturing Technology (AMT) recently released its Tariff Impacts on Manufacturing Technology: 2025 Q3 Spot Survey which indicates tariffs are reshaping pricing, sourcing and investment timelines for manufacturers. With the most Section 232 steel and aluminum tariffs, the AMT's survey results show manufacturing companies are experiencing price increases and complexity which is presenting a number of challenges.

Data and charts come from the association’s Confidential Shipment Statistics (CSS) program where over 70 manufacturers of fluid power products report their monthly orders and shipments.

Have thoughts to share on how the fluid power industry has fared in 2025? Take our brief survey below to offer your insights.

About the Author

Sara Jensen

Executive Editor, Power & Motion

Sara Jensen is executive editor of Power & Motion, directing expanded coverage into the modern fluid power space, as well as mechatronic and smart technologies. She has over 15 years of publishing experience. Prior to Power & Motion she spent 11 years with a trade publication for engineers of heavy-duty equipment, the last 3 of which were as the editor and brand lead. Over the course of her time in the B2B industry, Sara has gained an extensive knowledge of various heavy-duty equipment industries — including construction, agriculture, mining and on-road trucks —along with the systems and market trends which impact them such as fluid power and electronic motion control technologies.

You can follow Sara and Power & Motion via the following social media handles:

X (formerly Twitter): @TechnlgyEditor and @PowerMotionTech

LinkedIn: @SaraJensen and @Power&Motion

Facebook: @PowerMotionTech

Leaders relevant to this article: