June 2025 Fluid Power Shipments Data Brings Glimmers of Positivity

The National Fluid Power Association (NFPA) has released its fluid power order and shipment data for June 2025 which shows more positive conditions may be emerging for the hydraulics and pneumatics sector.

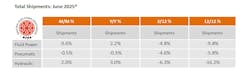

NFPA data shows June 2025 total fluid power shipments were down just 0.6% from the previous month but up 2.2% compared to June 2024. This is an improvement from the May 2025 data which indicated shipments decreased 0.7% and were down on a year-over-year basis.

While the May data indicated the pneumatics segment was potentially heading into recovery territory, the June data shows the same may now be true for the hydraulics sector. Per NFPA, the 12/12 rate of change for total hydraulic shipments has gradually grown more positive over the last 3 months. The total hydraulic shipments’ 3/12 rate of change has similarly improved from double digit negatives into the single digits for the first time since April 2024.

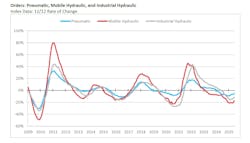

The association noted in its report announcing the June data that base year adjustments were applied to the mobile hydraulic order component category, which subsequently impacted aggregated hydraulics categories. As a result, notable changes occurred in the orders data for those areas for the final last month as well as the June preliminary.

Hydraulics Remain Impacted by Softness in Industrial and Mobile Machinery Markets

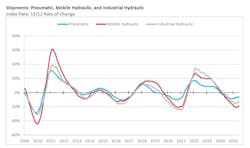

The next two graphs show the 12/12 rate of change trend lines for pneumatic, mobile hydraulic and industrial hydraulic shipments and orders which appear to be moving upward.

As the graphs show, the pneumatics segment continues to fare better than both the mobile and industrial hydraulics sectors, with mobile hydraulics remaining the lowest performing segment. This aligns with how the industrial and mobile machinery markets have performed to date in 2025.

Industrial machinery started the year on a more positive trajectory, but as uncertainty about tariffs persisted, this sector has seen some ups and downs, though still faring better than the mobile sector.

Christopher Chidzik, principal economist at The Association for Manufacturing Technology (AMT), noted in a recent press release from the association that its members have reported rising demand for manufacturing technology during the first half of 2025. This in turn has likely benefited those in the pneumatics and industrial hydraulics sectors of the fluid power industry whose technologies are utilized in a wide range of manufacturing machinery.

Gain more insights on current sentiments in the industrial market in the article "Optimism Surfaces From Several Corners of the Industrial World" from Endeavor Business Media partner site Industry Week.

Machine demand in the mobile equipment industry has remained muted, as the Association of Equipment Manufacturers’ (AEM) June 2025 Ag Tractor and Combine reports demonstrate. June saw declines yet again for sales of tractors and combines in the U.S. Meanwhile, Canadian sales continued to climb, maintaining the upward trajectory they have been on since February 2025 which is likely helping some in the hydraulics industry serving this market.

“We know farmers are hesitant to make major investments with global trade instability, high interest rates, and increased input prices. We’re encouraged by Canada’s continued strong performance throughout these summer months. The passage of the One Big Beautiful Bill Act is also a significant step forward for the agricultural equipment industry,” said AEM Senior Vice President Curt Blades stated.

Recent financial reports from companies in the fluid power industry also shed light on how the sector and its customer markets are performing.

Helios Technologies noted in its second-quarter 2025 financial results that lower sales for its hydraulics segment were due to softness in its industrial and mobile end markets. Despite the dip in sales the company saw for its hydraulics products, Sean Bagan, President, Chief Executive Officer and Chief Financial Officer of Helios Technologies, said performance during the first half of 2025 did exceed expectations.

He also went on to say that while uncertainty associated with tariffs and weakness in several end markets will persist, the company is expecting modest growth for the full year over 2024 due in part to the better than expected first half performance and “the approaching convergence of orders to sales.”

Parker Hannifin’s Fiscal 2025 fourth quarter, which ended June 30, saw an organic sales growth of 2%, with the company indicating its North American Industrial Segment recording the most growth during the quarter.

It also saw order rates increase in both the commercial and defense segments of its Aerospace business, which it anticipates being the company’s fastest growing business division again for the 2026 fiscal year.

The charts in this article are supplied by NFPA and drawn from data collected from more than 70 manufacturers of fluid power products by NFPA’s Confidential Shipment Statistics (CSS) program.

Get More Market Information

For even more economic and market trends information for the fluid power industry, visit our State of the Industry page. There you'll find video interviews, articles and more overviewing current and future market information as well as insights on how these trends could impact hydraulic and pneumatic system designs.

You can also sign up for our monthly Market Trends newsletter to have economic and technology trend insights sent directly to your inbox.

About the Author

Sara Jensen

Executive Editor, Power & Motion

Sara Jensen is executive editor of Power & Motion, directing expanded coverage into the modern fluid power space, as well as mechatronic and smart technologies. She has over 15 years of publishing experience. Prior to Power & Motion she spent 11 years with a trade publication for engineers of heavy-duty equipment, the last 3 of which were as the editor and brand lead. Over the course of her time in the B2B industry, Sara has gained an extensive knowledge of various heavy-duty equipment industries — including construction, agriculture, mining and on-road trucks —along with the systems and market trends which impact them such as fluid power and electronic motion control technologies.

You can follow Sara and Power & Motion via the following social media handles:

X (formerly Twitter): @TechnlgyEditor and @PowerMotionTech

LinkedIn: @SaraJensen and @Power&Motion

Facebook: @PowerMotionTech

Leaders relevant to this article: