Positive Outlook for Fluid Power Despite Electronics Making Inroads

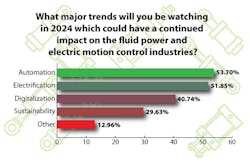

After a few years of strong growth, the consensus is that the global economy is headed for a slowdown in 2024. However, a positive outlook remains for the fluid power and electronic motion control sectors as efforts to electrify vehicles and machines continue as well as infrastructure and reshoring projects – all of which will help drive demand for motion control components.

Technological advancements taking place in hydraulics and pneumatics will benefit the market as well. Improved efficiency, more compact designs and increased power density are just some of the areas of focus which will help meet customer and market needs going forward.

Even as electronic alternatives start to make inroads in more applications, there are still many instances where hydraulic or pneumatic solutions are the preferred option. Both types of motion control technologies will see continued growth in the coming years as each offers unique benefits which suit the various applications they serve.

The greater integration of electronic and fluid power technologies will benefit the market as well by bringing new performance capabilities to help meet the evolving needs of customers – including those developing electric and autonomous vehicles.

To get a better sense of current and future market trends, Power & Motion surveyed its audience as well as spoke to several members of the industry to gain their insights on the state of fluid power and electronic motion control.

Demand for Hydraulics will Remain Strong

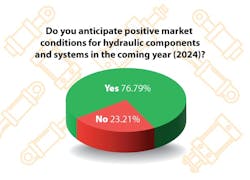

The majority of respondents, 77%, anticipate positive market conditions in 2024 for hydraulic components and systems. Many noted the technological advancements taking place in the industry as a reason for its expected positivity, as well as the move to electrification and automation – both of which will still require hydraulic components.

One respondent even said the rush to electrify everything is actually increasing demand for traditional products. Another noted the continued electrification of hydraulics and enhanced power versus weight ratios will positively affect hydraulics growth.

Continued demand in the oil and gas markets and the need for hydraulics in the construction equipment being used for infrastructure projects and building of new manufacturing facilities will benefit the market as well.

Ken Baker, CEO of Baily International, said the company is predicting a soft landing for the hydraulics market in 2024 as the economy slows down. Availability of components was a large market driver over the past 2-3 years but that is starting to normalize, which will play into the expected market slowdown.

“We're more optimistic than some people in the industry in general, but we are seeing it slow down. And I think that's going to be the key to watch,” said Baker. “We're trying to keep a careful eye on our inventory, because you can get ahead and inventory too much, but you don't want to be caught short when you see the rebound coming.”

For the 23% of respondents who do not believe there will be positive market conditions in 2024, several noted the market slowdown as a reason, as well as competition from electronic options.

Jeff Herrin, senior vice president of Research, Development, and Engineering at Danfoss Power Solutions, said borrowing costs could have an impact on the hydraulics industry in 2024. “Interest rates are unusually high, which could delay machine purchases due to financing costs. While temporary, this affects not just OEMs, but many others in the supply chain.”

He also noted single- and multi-family housing construction is slowing down and there is significant fluctuations in grain and commodity prices – both of which could impact the construction and agricultural equipment markets, the largest customer segments for hydraulics.

As such, Herrin said Danfoss is predicting a down cycle for mobile machinery but in other customer segments limited growth. He agreed with Baker that the good news in the market is the supply chain disruptions are largely gone “and we’re getting back to the market fundamentals of borrowing costs and supply and demand. This is the first time in 3 years we can say that.”

On the technology side of things, it is clear the integration of electronics and continued trend toward electrification are having an impact on the hydraulics industry. According to Matteo Arduini, President of Hydraulics EMEA (Europe, Middle East and Africa) and Rick Martich, President of Hydraulics, Americas and SVP, global Operations and Systems Sales at Helios Technologies, one of the most significant developments in the industry is the rise of electrohydraulics.

“The market is moving away from defining and specifying hydraulics and electronics in isolation,” said Arduini and Martich in an interview with Power & Motion. “Instead, there is a push for these elements to be integrated into intelligent systems that offer enhanced efficiency and functionality.”

Baker said Bailey International sees a continued electrification of hydraulic circuits but doesn’t foresee a replacement of hydraulics by electrical products because of the physics involved. “But we do see more sensors, more controls, more electrohydraulic valves, and more monitoring of the system. And we’re seeing that move from the high tier ones down in the middle market.”

Energy efficiency is a key area of development as well according to Herrin, both on a component and system level. “At Danfoss, it's been our experience that the bigger efficiency lever is at the systems level because we can optimize machine operation, and therefore power consumption, through software and electronics,” he said.

Tim Bankhead, Application Engineering Manager, North America at HydraForce/Rexroth, a Bosch Company, said energy savings is a perennial concern for the company and its development efforts.

“The best minds in fluid power are finding ways to create more compact, powerful, energy-saving and sustainable solutions to address the application of hydraulics regardless of the power technology driving those machines,” he said.

Technology Advancements to Benefit Pneumatics

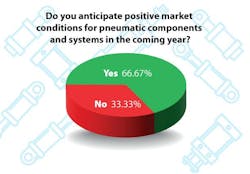

Those in the pneumatics sector also anticipate positive conditions in 2024, though just 67% of survey respondents indicated as such. Some of the reasons respondents said they see continued positivity in the market include the lower energy costs associated with pneumatics as well as the faster motion and response possible with these systems.

It was also noted that the continued integration of pneumatics with robotics will benefit market growth as well as additional pressures in the manufacturing industry to be efficient which pneumatic systems can help achieve.

For the 33% who do not see positive conditions for the pneumatics market in 2024, reasons included the anticipated economic slowdown as well as decreased demand for these components and electrical options replacing pneumatics in some instances.

Similar to the hydraulics market, there are several economic factors which could negatively affect the pneumatics sector such as commodity prices and high interest rates said Melissa Childers, Business Development Manager, Motion Systems Group, Pneumatics Division at Parker Hannifin. However, she said she expects the pneumatics market to strengthen in performance in 2024.

“We are seeing growth from the previous year in our system solutions for our door systems for the bus and coach market as well as our CTIS [central tire inflation system] technology,” she said.

Rex Bateman, Director of Engineering at SMC Corp., said ongoing labor strikes and the continuation of a soft market could present economic headwinds for the pneumatics industry in 2024. The semiconductor industry, which utilizes pneumatic systems, is currently experiencing a significant slowdown, he said, and it may be late 2024 before it starts to recover.

But overall, he sees the pneumatics market continuing to grow as the need for automation rises as pneumatic components can play an important role in these systems. In addition, there are opportunities for the use of pneumatics in alternative energy and sustainability solutions.

Several advancements in pneumatic system designs have increased their capabilities. Bateman said SMC has improved its pneumatic actuator designs to increase controllability in positioning, speed, acceleration and deceleration which could offer advantages over electric solutions.

Frank Langro, Director - Product Market Management, Pneumatic Automation at Festo North America, said improvements in force control is one of the development areas that will impact pneumatic systems going forward. One way in which Festo has addressed this is using piezo electric technology instead of the more commonly used solenoid pilot valve.

“Piezo technology enables precise control in processes such as wafer polishing and battery winding. Improvements to these processes reduce waste and are vital as the demand for semiconductors and rechargeable Li-ion (lithium-ion) continues to rise,” he said.

In addition, Langro said piezo pilot valves use up to 95% less energy than solenoid valves which helps meet the growing industry trend toward increased energy efficiency.

Electronics Bringing New Capabilities, Alternative Technologies to Market

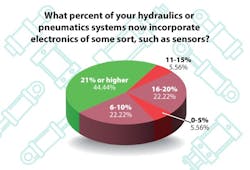

Integration of electronics within fluid power systems is increasing. Forty-four percent of respondents to Power & Motion’s survey said that 21% or more of their hydraulic and pneumatic system designs now incorporate electronics of some sort such as sensors. This was followed by another 44% who were split between 16-20% and 6-10% of their systems incorporating electronics.

Each of the industry members we spoke to also said they see this trend increasing. In the case of sensors, their use can aid with enabling more precise movements of hydraulic and pneumatic components as well as gathering of performance data to help improve maintenance. Festo’s Langro said that today the information coming from many devices not only detects failures but also helps to predict them, minimizing downtime and thus costs for end use customers.

Baker said the rising use of sensors is helping meet customers’ desire for highly accurate systems, especially for safety and service purposes. Position sensors are the type Baily International sees the largest requests for; this is not surprising given the rising development and use of machine control systems and automation – knowing the position of a machine or one of its parts helps to ensure safe and optimal movements.

Visit our State of the Industry hub for the full Q&As with the industry experts featured in this piece as well as video interviews and additional industry insights.

Bankhead of Hydraforce/Rexroth said there is a trend toward integration of digital electronic technologies such as hydraulic controls with onboard electronics and integrated sensing. “The integration of sensors is a critical path to adding value to the market with digitally connected hydraulics,” he said.

Herrin said the discussion of electronic control systems taking the place of mechanical controls has been taking place for years. “I can remember when electronically actuated hydraulics made up 5 or 7% of the market. Now we’re well above 50%,” he said. “The use of electronic controls is a long-term trend that will continue. A key reason is that OEMs want to differentiate and customize their solutions, and that is almost always done with software today. Hydraulic components have to be electronically actuated to work with these custom solutions.”

Childers noted the move toward Industry 4.0 as a driver for the greater integration of electronics as well. In addition to integrating sensors, portals and communication networks enable collection and monitoring of collected data to ensure productivity of a system or machine. She said Parker offers a solution with built-in diagnostics capabilities which helps to detect short circuits in valves and monitor valve cycles, aiding with maintenance of the pneumatics system.

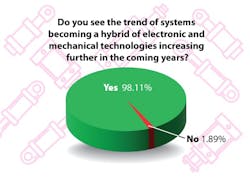

As electronics become more integrated with hydraulics and pneumatics, there will likely be more of a hybridization of these systems. The vast majority of survey respondents, 98%, said they see the trend of systems becoming a hybrid of electronic and mechanical technologies increasing further in the coming years.

Market Share for Electric Actuators Increasing

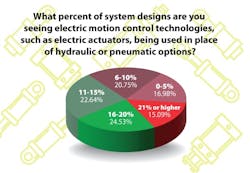

In addition to electronics being incorporated with hydraulic and pneumatic technologies, there are increasing instances of electric actuators and other technologies being used in place of fluid power options. Most survey respondents indicated they see this trend, and were fairly evenly split between how much they see electric options being used in place of fluid power technologies.

Twenty-four percent said they see as much as 16-20% of system designs using electric motion control technologies in place of hydraulic or pneumatic options. Just 15% said they see 21% or more of systems using electric alternatives – indicating this is a growing trend but there remains space for hydraulic and pneumatic technologies.

When asked if they see electric options ever fully displacing hydraulics or pneumatics, the majority of survey respondents said they do not see this happening. Several noted the fact that the power density of hydraulics in particular cannot be beat. Others said there will always be applications which require the use of hydraulics or pneumatics.

Automation and the positioning accuracy and repeatability possible with electric actuators for robotics were some of the reasons given by those who see the use of electric options increasing.

Andrew Zaske, Vice President of Sales and Marketing at Tolomatic, said the increasing demands of uptime, repeatability and reduced maintenance are among the reasons people are moving toward use of electric actuators. He also said the company is seeing growing interest in using electric actuators in place of hydraulics in new areas.

Tom Diedrichs, Product Manager Actuators at Ewellix, sees this trend occurring as well. “There is a general push for hydraulic replacement in all types of applications that see value in the benefits that electromechanical actuators [aka electric actuators] bring,” he said which includes efficiency, energy use and better position accuracy.

Another benefit he points to is safety – with electric actuators there is no chance of hydraulic fluid leaking and causing harm to humans or the environment. In addition, because there are no fluids working under high pressures, safety issues are mitigated when maintaining systems.

When determining whether to use a fluid power or electric motion control solution, it is important to evaluate the application and performance requirements as well as component and system costs and productivity gains said Bateman.

As Moog Inc. stated to Power & Motion, “In today’s world, it is critical to understand that power and motion control is a shared space between fluid power and electric technologies. For example, Moog Construction collaborates with OEMs on their power, motion, and sustainability efforts by looking at the crossroads of hydraulics and electric power technologies. In the case of a tractor loader backhoe or excavator, a manufacturer might want to have a vehicle’s wheels or tracks powered by an electric motor while the machine’s working hydraulics would employ hydraulic actuators powered by an electric motor and battery system.

“Determining what’s best for an application will, in Moog’s opinion, continue to guide technology selection and innovation with hydraulic, hybrid, and fully electric power and motion control solutions.”

Overall, a positive sentiment remains for the fluid power industry even as electric options are becoming more common. Most survey respondents, 58%, foresee the hydraulics and pneumatics market performing somewhat positively over the next 5 years, and 26% see it performing very positively.

About the Author

Sara Jensen

Executive Editor, Power & Motion

Sara Jensen is executive editor of Power & Motion, directing expanded coverage into the modern fluid power space, as well as mechatronic and smart technologies. She has over 15 years of publishing experience. Prior to Power & Motion she spent 11 years with a trade publication for engineers of heavy-duty equipment, the last 3 of which were as the editor and brand lead. Over the course of her time in the B2B industry, Sara has gained an extensive knowledge of various heavy-duty equipment industries — including construction, agriculture, mining and on-road trucks —along with the systems and market trends which impact them such as fluid power and electronic motion control technologies.

You can follow Sara and Power & Motion via the following social media handles:

X (formerly Twitter): @TechnlgyEditor and @PowerMotionTech

LinkedIn: @SaraJensen and @Power&Motion

Facebook: @PowerMotionTech

Leaders relevant to this article: