2023 Fluid Power Market Outlook: Slowing Growth Cycle Ahead

Positivity has been the general sentiment for the fluid power industry in 2022. Strong demand from the various markets served by hydraulic and pneumatic components, such as construction machinery and manufacturing, kept order and shipment totals in growth territory for much of the year.

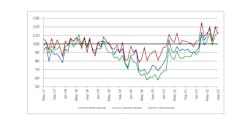

The National Fluid Power Association’s (NFPA) industry data for September – the most recently available at the time of publishing – showed continued growth for shipments of pneumatics, hydraulics and total fluid power on a 12-month moving average. This was a common trend in NFPA’s monthly industry data reports throughout the year.

However, as we head into 2023 some of this positivity seems to be waning due to inflation and interest rate increases as well as global factors causing uncertainty about the economy. Growth for 2023 is expected to be lower, but this does not necessarily spell trouble for the fluid power industry or the greater economy.

During an economic webinar hosted by NFPA, Patrick Luce of ITR Economics emphasized several times that while a recession is ahead, it will be a mild, cyclical one. Growth will be slower in the coming year, but it will still be growth. He noted it is important to put the forecasted trends for 2023 into perspective as the declines will be nothing like those seen in 2008, and the past 2 years were periods of robust growth as the global economy returned to a semblance of normalcy after the onset of the COVID-19 pandemic.

There are of course various factors which could alter forecasts and which could directly impact the fluid power industry, but the consensus is 2023 will be a period of slow growth followed by higher growth trends in 2024.

U.S. and Global Economic Factors

Many U.S. and global indicators are showing a trend to slower growth in 2023 said Luce. Industrial Production for both the U.S. and the world are trending toward what he referred to as a soft landing in which slow growth will occur but contraction is not expected during the business cycle.

Mixed signals are coming from various parts of the world. Australia, Brazil and China are among non-U.S. trade partners with indicators showing a rising growth trend while other markets such as Canada and the Eurozone are facing declines. For the latter, the energy crisis has the potential to cause some serious impacts.

When it comes to the U.S. economy specifically, Luce said it is important to follow the data and not the headlines. Despite some news sources saying the economy is collapsing and Americans believing this is true, he said third quarter 2022 GDP reached record high levels. The quarter saw growth in personal expenditures and exports, both of which are good for the economy.

Inflation is a concern for many. Luce said the economy has entered a disinflation trend from a macro perspective and deflation is occurring with many commodities, such as copper and steel:

- Disinflation = price growth is slowing.

- Deflation = prices are going down.

This easing of commodity prices will benefit manufacturers of all types by helping to lower their input costs.

There are issues facing the U.S. economy such as the labor market. Finding and paying workers has been challenging for businesses. However, the rise in wages which has occurred due in part to the tighter labor market has benefitted consumer spending and thus the economy.

Signals of cyclical decline are showing for the U.S., however the floor is not going to fall out from underneath us. Luce pointed out these signals existed before the war in Ukraine or the Federal Reserve’s interest rate increases.

Further interest rate increases have the potential to disrupt the forecasted trends, although the impacts happen asymmetrically throughout the economy he said. The housing market is already feeling the effects by negatively impacting affordability due to higher mortgage rates. But when it comes to the broader macro economy, it takes more time for the effects of higher interest rates to be felt said Luce and would be closer to the 2024 timeframe if they were to cause a disruption of any type.

How Will Fluid Power Fare?

The fluid power industry and the markets it serves will follow the slowing growth trends expected in the greater economy. Based on current economic conditions, ITR is forecasting 2022 to end on a growth rate of 16.1% and 2023 to dip to -1.8% before rising again in 2024 to 6.2%.

Luce noted there has been more upside movement for hydraulics than previous forecasts likely due to the improvements in supply chain conditions which have slowly started to take shape. This and continued business to business spending have benefited the fluid power industry in 2022. Hydraulic shipments are expected to end the year at 17.7% and those for pneumatics at 7.0%.

READ MORE: Mobile Hydraulics Market Rebound in 2021 Leads to Positive Future

Fluid power component manufacturers have reported positive results to date for 2022, reflecting the data from ITR. In August, Danfoss raised its outlook for the year based on its 6-month growth performance. The company noted in a press release on the subject the Danfoss Power Solutions business achieved significant growth during the first half of the year. Danfoss said it expects further sales growth for the second half of the year.

More recently, Parker Hannifin reported a 12% sales increase for its fiscal 2023 first quarter which ended September 30, 2022. The company grew orders in all of its business segments during the quarter, and is expecting fiscal 2023 organic sales growth to be in the range of 4.5-7.5%.

An NFPA survey of manufacturer and distributor members taken in August 2022 showed the majority of manufacturers expect the next 12 months of shipments to be above those of the previous 12 months. Distributors were a little more split between shipments being above or the same as the previous 12 months.

After such high growth rates in 2022, both hydraulics and pneumatics are expected to dip in 2023 before rising again in 2024. Hydraulics are forecast to achieve a growth rate of -0.7% in 2023 and rebound to 7.8% in 2024. Pneumatic shipments in 2023 are forecasted to reach -2.1% and 5.3% in 2024.

Heavy Equipment Demand Will Soften

Of the many markets served by fluid power, mobile equipment is one of the largest and has been particularly beneficial for the hydraulics segment due to strong demand for construction equipment, agricultural machinery and other heavy-duty vehicles.

The mobile equipment market has experienced strong demand over the past 2 years with the growth of infrastructure projects around the world and the ongoing need to feed a growing population as well as deliver goods. As such, several OEMs have reported positive results to date in 2022, signifying the strength of these markets.

For instance, our colleagues at Construction Equipment report construction and mining equipment OEM Komatsu had a 25.3% sales increase during the first half of its fiscal year. Also on the construction and mining side, Volvo Construction Equipment reported a 23% increase in sales during the third quarter compared to 2021. The company said every market outside of Europe and China saw high levels of activity and strong growth.

Agricultural machinery, another strong mobile hydraulics market, has remained in relatively positive territory during 2022. Equipment manufacturer AGCO reported record net sales in the third quarter; sales were up 14.5% due to strong demand from North and South America. The company said its North American sales for the year are up about 43% on a year-over-year basis.

The Association of Equipment Manufacturers’ (AEM) October Tractor and Combine report showed double-digit gains for combine harvesters during the month but total tractor sales down in both the U.S. and Canada due to a decline in sales of sub-40 hp tractors. Growth was achieved though in all tractor segments above 40 hp, and total U.S. ag equipment unit sales in October 2022 remained above the 5-year average for the third month in a row.

Similar to the rest of the economy, these and other markets served by fluid power are expected to see slower growth trends in 2023.

Mild contraction is expected in 2023 for the construction equipment market, said Luce during the NFPA webinar. It is an interest rate sensitive industry and is feeling some impacts from the effects rate increases are having on the housing market which is softening demand for construction equipment. But as a counterbalance, he said while single and multifamily housing is slowing non-residential construction is entering a rising trend which will benefit the market. Construction is forecast to end 2022 at a growth rate of 12.9%, dip to 0.3% in 2023 and rise again in 2024 to 5.5%.

Agricultural machinery is also expected to experience a mild decline compared to previous cycles said Luce. Demand and existing backlog will be a factor for this market as well as the fact that food is a non-discretionary item and therefore trends differently than the macroeconomy. This segment is expected to end 2022 at a growth rate of 3.4%, achieve growth of 5.1% in 2023 and grow again in 2024 at 8.5%.

Material handling has benefited from the growth in e-commerce and distribution as well as the efforts to onshore here in the U.S. and other parts of the world. Interest rate increases are a factor for this segment, causing companies to re-evaluate their capital expenditure spending. Like the other segments, slower growth is anticipated but it is expected to be a very flat rate of change said Luce.

Easing of Supply Chain Pressures

With the slowing growth trends coming in 2023, it is anticipated supply chain pressures will ease. Already there has been some indication of improvements; Luce said both the global supply chain pressure index and the Purchasing Managers Index (PMI) – which has about a 7-month lead time and is a key economic indicator – are showing further easing of supply chains.

Although some are still experiencing long lead times, he said ITR has heard from many clients that lead times are coming down and shipping containers, especially those from the Pacific, are flowing more fluidly than they were previously.

There are of course still a lot of challenges associated with the supply chain. For example, weakness in activity coming out of Europe and particularly from Germany and Italy is expected. Much of this is due to the energy crisis the continent is likely going to face during the winter months due to the conflict between Ukraine and Russia.

But as noted previously, there are positives in the market with prices lowering for commodities and fuel which will benefit many businesses. Pricing pressures in general will be easing as the economy slows after what Luce termed the post-COVID sugar rush that caused such high demand for so many goods over the past 2 years.

Positivity is starting to show in the global semiconductor industry which will benefit an array of markets. Luce said delivery times declined by 4 days in September, the biggest drop in years.

Light vehicle and heavy-duty truck production are among the markets benefiting from the increased availability of semiconductors. Both are expected to see rising trends going forward as demand will remain at a high level and manufacturers can now better meet it with the greater availability of semiconductor chips. Growth is expected through 2023 for both vehicle segments before entering a slowing growth phase. Luce said there will be a good ramp up of activities in these markets and if fluid power manufacturers have the ability to get into them, now is the time.

Given most chips come from Taiwan currently, the U.S. Government is trying to incentivize catch up after a decades long stagnation of domestic supply said Luce. In August, President Biden signed the CHIPS and Science Act into law to help invest in more U.S. production of semiconductors as well as scientific research and STEM initiatives.

READ MORE: How the CHIPS and Science Act Will Benefit Fluid Power and Motion Control Manufacturers

Although construction is underway for production facilities, it takes a long time to get them built and up to full capacity. So it will be some time yet before reaching the needed capacity, so businesses should not expect the CHIPS Act to benefit their 2023 or 2024 plans.

Key Takeaways for 2023

In general, from a financial and economic perspective the U.S. economy is fairing well and will continue to do so in the immediate future as consumers are financially healthy and businesses have recorded record profits, enabling them to weather inflation and higher interest rates.

The higher interest rates could pose a risk to the core markets served by fluid power, making it important for businesses to understand how they interact with those and possible exposure to any risks. But again, Luce noted the growth expected in the light vehicle and heavy-duty truck markets could help counterbalance the lower growth rates of other markets such as construction equipment.

Any risks from interest rates and further increases likely will not materialize into a macroeconomic contraction until 2024. This provides companies with time to maneuver their business and prepare for any possible economic impacts.

Luce emphasized several times during the NFPA webinar that the slowing growth cycle ahead is not necessarily a bad thing. It will provide many manufacturers and other businesses with a chance to catch their breath after working hard to meet the high levels of demand experienced since late 2020.

This period will provide a chance to ease backlogs and focus on longer term plans such as finding ways to improve efficiencies and new opportunities. It will enable companies to schedule downtime for equipment maintenance and prepare for the high rates of growth coming in 2024.

It can also be a time to focus on investing in the company, both in terms of equipment and labor.

There are aspects of the economy and various markets to be mindful of, but overall the economy is not collapsing and 2023 will provide opportunities to reset before the ramp up in activity expected in 2024.

About the Author

Sara Jensen

Executive Editor, Power & Motion

Sara Jensen is executive editor of Power & Motion, directing expanded coverage into the modern fluid power space, as well as mechatronic and smart technologies. She has over 15 years of publishing experience. Prior to Power & Motion she spent 11 years with a trade publication for engineers of heavy-duty equipment, the last 3 of which were as the editor and brand lead. Over the course of her time in the B2B industry, Sara has gained an extensive knowledge of various heavy-duty equipment industries — including construction, agriculture, mining and on-road trucks —along with the systems and market trends which impact them such as fluid power and electronic motion control technologies.

You can follow Sara and Power & Motion via the following social media handles:

X (formerly Twitter): @TechnlgyEditor and @PowerMotionTech

LinkedIn: @SaraJensen and @Power&Motion

Facebook: @PowerMotionTech

Leaders relevant to this article: