2016 Hydraulics & Pneumatics Salary & Career Report: An Industry That Is Content, But Specialized Skills Can’t Hurt

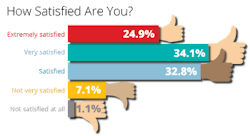

More than 1,500 fluid-power engineers and professionals from across the country participated in the Hydraulics & Pneumatics 2016 Salary and Career Report, providing insight about changes in the industry, compensation, and overall job satisfaction. The average annual salary increased by 3%—which has been the average income increase since 2014, according to consulting firm Towers Watson—for a final amount of $95,167. While 49.4% of respondents report an increase in salary since last year, 37% said theirs stayed the same.

Others recommend that fluid-power engineers develop skills in other areas that are becoming increasingly integrated into fluid-power systems. These include skills in industrial electronic controls, PLC programming, and BUS/Ethernet communications. One design and development engineer says, “Instead of just recommending hydraulic components, a big part of my job is designing and developing the control software to work with the hydraulics.”

Nearly half of respondents say their company currently outsources work, mostly because they lack in-house services and want to make use of existing engineering resources. Three quarters of respondents say their companies participate in onshore outsourcing, while a quarter reports outsourcing to India, and 11% to China. The most outsourced work is manufacturing and assembly, followed by CAD/CAE, and software engineering/development.

The sample is split into thirds when it comes to optimistic, pessimistic, and neutral outlooks on the health of the economy. "Election year brings uncertainty with company spending. I think it will be a harder year for companies to invest in machinery until a clear path is known from the government on taxes/spending," says one commenter.

About the Author

Leah Scully

Associate Content Producer

Leah Scully is a graduate of The College of New Jersey. She has a BS degree in Biomedical Engineering with a mechanical specialization. Leah is responsible for Hydraulics & Pneumatics’ news items and product galleries.